This week, brands were given a sharp reminder of the danger in promising something they can't deliver.

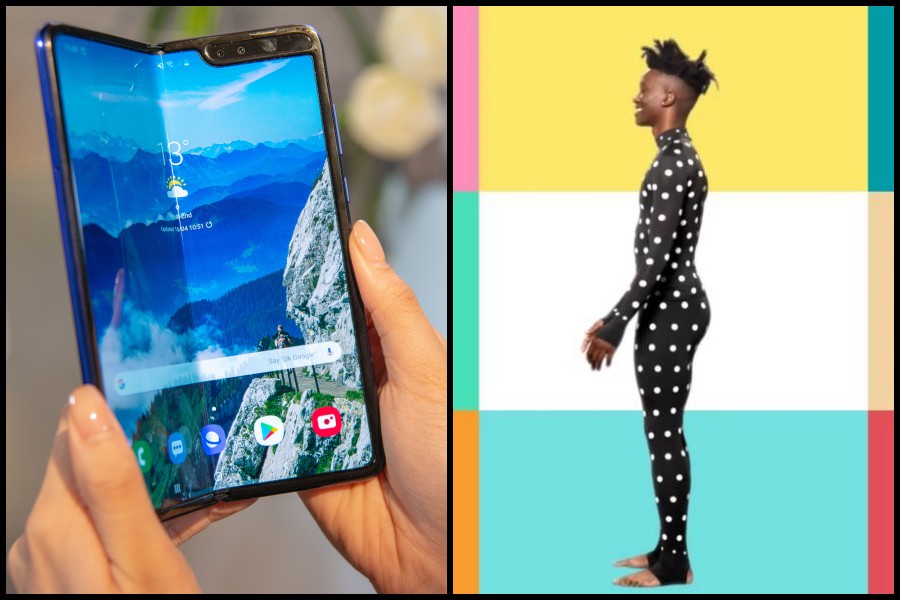

First, Samsung was forced to delay the launch of the Galaxy Fold after reviewers found test versions of the nearly $2,000 phone to be faulty. Then yesterday, Zozo, the Japanese online clothing retailer, announced the closure of its international service after the prolonged misfire of its much-hyped online measurement service for body dimensions.

Both cases are embarrassing setbacks for the companies, one a consumer electronics giant, the other an unknown quantity outside its home market but with similarly big ambitions—to change the way people buy mass market clothes and in so doing become a global leader that would rival the likes of Uniqlo.

In an effort to demonstrate its innovation credentials, Samsung rushed to be the first to offer a mass-market foldable smartphone. A Bloomberg reviewer described the product as one that the market showed little demand for, and which despite its high price offered an inferior experience both as a smartphone and a tablet—when functioning properly. The bigger issue was that it didn’t: pulling what appeared to be a screen protector off the display rendered the device useless. The company has now put off the launch indefinitely in order to determine what went wrong.

Zozo’s headache follows a PR blitz last year around its Zozosuit, a measurement system that was supposed to enable people to order affordable made-to-measure suits and casual clothes remotely. Touted as a vision of the future of retail and the driver of the brand's global expansion, it proved to be a logistical nightmare, with customers reporting waiting for long periods before receiving ill-fitting clothes that were frequently worse than cheap off-the-shelf alternatives. A Zozo spokesperson did not respond to an enquiry from Campaign earlier this week as to how the company plans to remedy the situation.

Yesterday, Zozo sent a notice to customers (received by Campaign reporter Jenny Chan) stating that it had closed its international shop in the Americas, Europe, Asia-Pacific and the Middle East and that it will delete all personal data by the end of July.

The two episodes invite questions around the tech industry’s mantra of embracing failure, which marketers feel under pressure to adopt but have done so hesitantly. “With innovation, it tends to be not the 'first mover', but the 'first mover who meets all consumer needs' that wins the big prize,” says Paul Galesloot, chief executive of the branding consultancy Cowan in Singapore.

But he notes that there is a big difference in the impact for the two brands based on their level of recognition and reserve of consumer good will. “Samsung has a lot of positive associations” as an established brand, he says, which help it remain credible. Outside Japan, where it has been successful as an ecommerce brand, “Zozo does not have many positive associations around their service offering, therefore has little to fall back on… If someone you love lies to you, you can probably forgive them and move on. If a stranger lies to you, will you ever invest your time in getting to know them?”

Failure is dangerous for startups, which have not had a chance to build credibility, agrees Prakash Kamdar, chief executive of Isobar Singapore, “unless they overtly inform their customers in advance that the product they are releasing is in Alpha or Beta stages, and that they are seeking customer feedback to help them improve the final product.”

Even if they do, there’s no guarantee of cushioning. Ofo is an example of a number of bicycle sharing services to have reached crisis point as a result of rapid expansion combined with lack of market research and service refinement.

Ultimately, Zozo appears to have been a victim of its own successful PR, which generated inordinately high expectations and put the brand promise ahead of its service capabilities. “High profile comes with high risk, so you need a lot of confidence in your product,” Galesloot says.

He points out that companies like Tesla have managed to move beyond failure thanks to a combination of vision and capital. Google also suffered little damage from its unsuccessful Google Glass, which despite a fair amount of hype was largely seen as a prototype with expected flaws “rather than an awesome innovation”.

But he thinks it looks difficult for Zozo to regain trust as an international brand because the service it advertised was central to its proposition. “They could try to find a new group of early adopters, either based on a geography or interest,” he suggests. “This might also require a rebrand. They launched with strong visual assets, which now have negative associations.

“The key part of any recovery plan would be to address the issues they are facing with the product and service. Otherwise, they can generate more hype, but it would be likely to result in more failure.”

It looks easier for Samsung to overcome the Galaxy Fold debacle, bearing in mind that the brand remained strong even after widespread spontaneous combustion in its Galaxy Note 7 in 2016. But the latest experience should encourage a management rethink around product launches.

“I doubt most brands set out to over-promise,” Kamdar says. “From experience, under-delivery is often the result of management putting teams under tremendous pressure to go to market quickly without giving them sufficient time to conduct robust testing of the tech innovation.”

So should brands persist in learning to love failure, as so many ‘gurus’ have advised them to? Perhaps, but they should do so behind the scenes, reserving marketing communications for when the product or service is fit for public consumption. Failure is only valuable “if you learn from it, and if it doesn’t destroy you,” Galesloot offers.