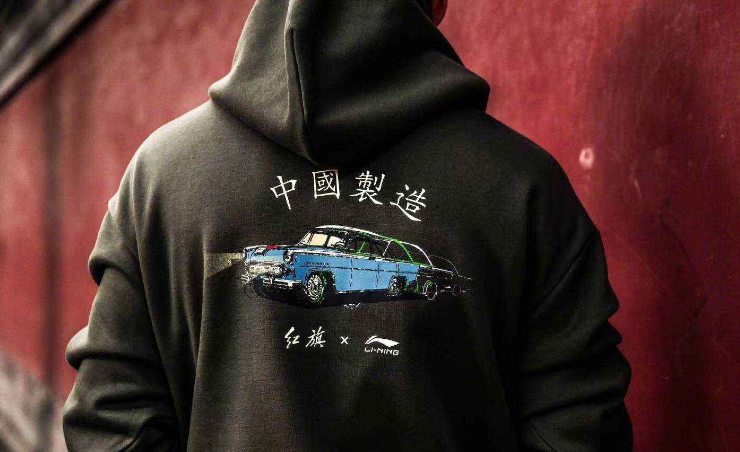

Huawei is still the top choice when Chinese consumers are asked to name the strongest local brands in a question that's part of Campaign Asia-Pacific's Asia's Top 1000 Brands research. However, Li-Ning, a Chinese sportswear brand, became the second most common answer given this year as it rides a wave of fondess for ‘guochao’.

“‘Guo’ stands for country, while ‘chao’ is taken from ‘chaoliu’, which means ‘fashionable’," explains Claire Zhao, vice president of strategy in China for Essence. "This has been driving increasing demand for Chinese homegrown brands and products that often incorporate local traditional culture and style."

Guochao is not just a trend, but a new concept “that has majorly impacted the economy in many aspects as the younger generation of Chinese experiences a renewed interest in their cultural heritage", Zhao says.

Over the past few years, Chinese Gen Z consumers have increasingly favoured Chinese brands such as Li Ning and Anta, with more and more young people being vocal in their support of local brands.

By sponsoring the national weightlifting team, “Anta products are now seen as a symbol of Chinese beauty and strength and have gained popularity on social-media channels like YouTube and Instagram”, Zhao says. Chinese weightlifting champion Lv Xiaojun donned gold Anta shoes in the Tokyo Olympics, for example, generating a lot of buzz on China’s social-media channels, she adds.

Other factors shaping brand images in the Chinese market include the boycott of Xinjiang cotton by some MNC companies, which triggered a backlash and boosted the rapid rise of local brands, which have a more emotional connection with Chinese customers. Overseas brands Nike and Adidas suffered dropping sales and have seen their ranking fall in our list of China's top 100 brands (see the list and our analysis).

Alex Duncan, a cofounder of Kawo, a marketing SaaS platform for WeChat, Weibo and Douyin, predicts that “in the future, for Chinese companies to succeed, they must become brands and form a stronger emotional connection with their consumers. Ultimately the brand is about an emotional connection between a company and its consumers.” He thinks that the success of WeChat could be attributed to its founder Allen Zhang’s “laser focus on users”.

Deciphering how Chinese brands win consumers’ hearts, Cecilia Huang, partner at consulting company Prophet, says that “their sense of trend, speed of launching new products to the market, and personalised marketing and channel strategy” are the main engines that drive them up. She explains that Chinese brands “penetrate into consumers' daily life tirelessly in every aspect and dialogue. In other words, they thrive through building the best relevance with Chinese consumers.”

The other brands on the strongest-local-brands list didn't see changes. Alibaba, Haier, Gree, Xiaomi, Tencent and Midea all remain the Top 10. Alipay, the epayment system from Alibaba Group, moved up to ninth place from 12th last year.

Zhao from Essence makes a comparison between Chinese and Japanese brands. “Looking at the growth of China’s economy in retrospect, Chinese brands have definitely been on the rise in popularity, similar to how Japanese brands rose in popularity in the 1970s to 1990s,” she says.

Competition remains fierce in the fast-moving market, and a top buzzword on social media, "involution", sums up anxieties within Chinese society that inevitably will impact brands.

Zhao analysed the key trends in the Chinese economy: “the fast-paced consumer-to-manufacturer business model, refreshing consumer perspectives from Generation Z, and a new level of consumer demand boosted by digitally led behaviours and mindsets".

Her suggestions for brands to overcome potential challenges include, “identify and successfully advocate their authenticity and differentiate themselves” and “innovate as well as integrate new, cutting-edge resources and ideas in their categories".