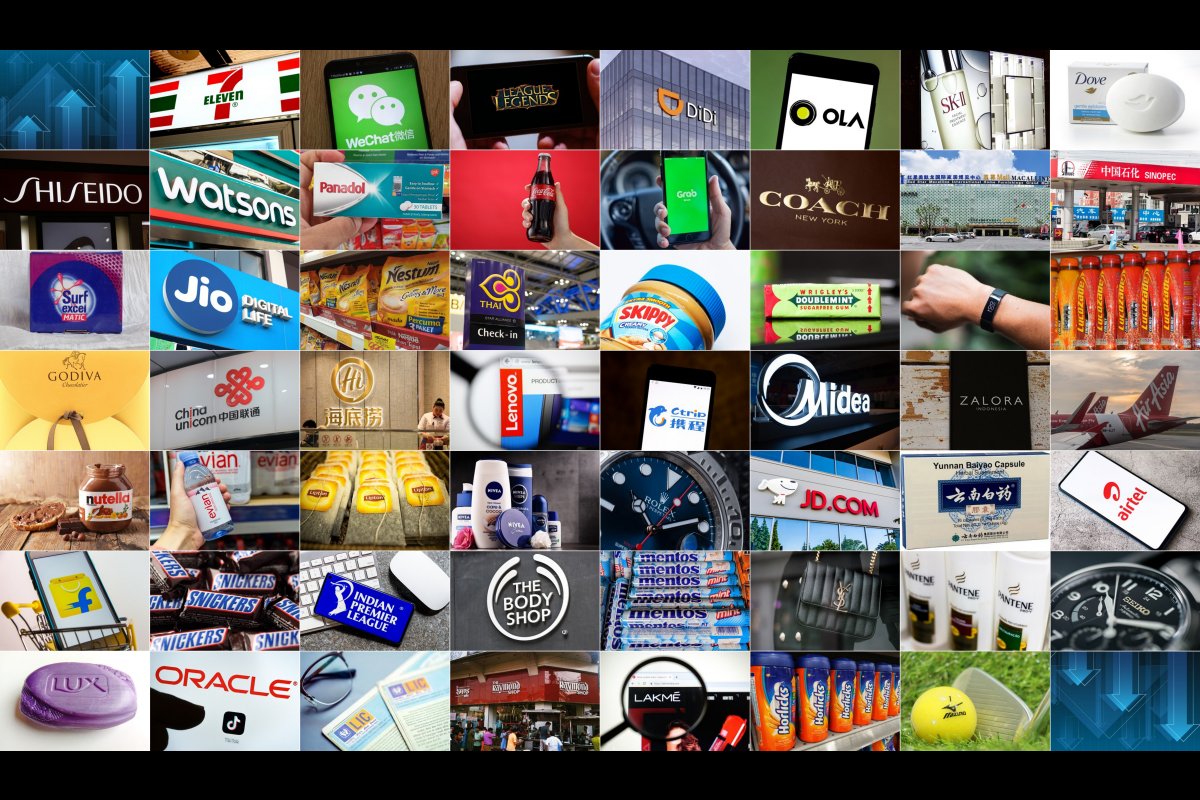

Each year when the new Asia's Top 1000 Brands data arrives from Nielsen IQ, one of the first things we do is apply some sorting in Excel to see which brands have moved the furthest up or down the ranking.

This year, due some methodology tweaks, this exercise revealed changes that were more eye-popping than usual. When you run a research project for over a decade and a half, you have to make adjustments along the way in order to capture reality to the best of your ability. The changes we made this year—especially giving more weight to the responses of people in China and India—aimed to do just that. And based on a large influx of Asia-based brands into the Top 1000 (213 brands entered the top 1000 this year, as opposed to 53 last year), we believe we succeeded.

That influx has led to larger than usual swings. While last year's largest gain (by an existing member of the Top 1000) was 363 positions, this year's biggest shift upward is a whopping 702 positions, and 14 brands moved up by more than 500 slots.

As in other years, our additions of or changes to categories (see the Methodology for details) also made an impact, which explains why you will see many gaming franchises and home-delivery services in the lists below.

With that as background, let's dig in.

We'll look in turn at the biggest shifts in each of the following areas:

- The top 10

- The (rest of the) top 100

- Overall

- By Tiers: 101-250, 251-500, 501-1000

THE TOP 10

In the rarified air of the top 10, the cast of characters remains unchanged from last year, and the top three brands (Samsung, Apple and Panasonic) appear in the same order. Past that a lot of shifting went on. Sony and Philips notched two-spot gains—significant at this level—while Nestle's five-position drop to 10th qualifies as earth-shaking, for the top 10.

See also: An in-depth look at what's kept Samsung on top for a decade now and an analysis of some of the actions that impacted the top five this year.

| Brand | 2020 | 2021 | Shift |

| Sony | 6 | 4 | 2 |

| Philips | 10 | 8 | 2 |

| Nestle | 5 | 10 | -5 |

THE (REST OF THE) TOP 100

The influx of brands popular in China and India, as well as our addition of categories for game franchises and delivery services, put a bunch of new brands into the top 100, including three that are new to the top 1000. The tables below show all the brands in the 2021 top 100 that moved by 10 positions or more.

Biggest gains in the top 100 (list includes all brands that gained 10 or more spots):

| Brand | 2020 | 2021 | Shift |

| Farmland | N/A | 82 | ∞ |

| League of Legends | N/A | 96 | ∞ |

| Grab Food | N/A | 97 | ∞ |

| Didi Chuxing | 263 | 45 | 218 |

| Ola | 234 | 87 | 147 |

| 117 | 27 | 90 | |

| Nintendo Switch | 167 | 81 | 86 |

| Huawei | 120 | 67 | 53 |

| SK-II | 143 | 99 | 44 |

| Dell | 100 | 59 | 41 |

| 7-Eleven | 101 | 60 | 41 |

| 69 | 35 | 34 | |

| Uber | 76 | 47 | 29 |

| Toyota | 66 | 38 | 28 |

| Burberry | 113 | 85 | 28 |

| Levi's | 68 | 43 | 25 |

| Epson | 82 | 57 | 25 |

| Oreo | 91 | 66 | 25 |

| Zara | 49 | 32 | 17 |

| Kellogg's | 59 | 42 | 17 |

| Michelin | 81 | 65 | 16 |

| Quaker | 92 | 76 | 16 |

| Lego | 95 | 79 | 16 |

| Christian Dior | 87 | 73 | 14 |

| Netflix | 67 | 54 | 13 |

| Nissin | 73 | 61 | 12 |

| L'Oreal | 47 | 36 | 11 |

| BMW | 83 | 72 | 11 |

| Ikea | 31 | 21 | 10 |

| Amazon | 33 | 23 | 10 |

| Huggies | 60 | 50 | 10 |

| Cartier | 84 | 74 | 10 |

| DHL | 103 | 93 | 10 |

Biggest drops in the top 100 (list includes all brands that lost 10 or more spots):

| Brand | 2020 | 2021 | Shift |

| Dove | 27 | 83 | -56 |

| Shiseido | 57 | 92 | -35 |

| Watsons | 34 | 68 | -34 |

| Grab | 43 | 75 | -32 |

| Kraft | 61 | 91 | -30 |

| Heinz | 29 | 51 | -22 |

| Coca-Cola | 11 | 31 | -20 |

| Facebook Messenger | 51 | 71 | -20 |

| Line | 64 | 84 | -20 |

| Uniqlo | 70 | 90 | -20 |

| Panadol | 44 | 62 | -18 |

| Calvin Klein | 53 | 69 | -16 |

| PayPal | 41 | 56 | -15 |

| Heineken | 74 | 89 | -15 |

| Yahoo | 72 | 86 | -14 |

| Meiji | 22 | 34 | -12 |

OVERALL

This section shows the 25 biggest gains and 25 biggest losses in the entire Top 1000 Brands list. The impact of giving greater weight to respondents in China and India is clear to see here, not only in brands that originate from those markets but also international brands that are very popular in them, such as Coach.

From here onward, we've excluded brands that are new to the Top 1000 this year, as their gains are technically infinite. In other words, we've listed only brands that were present in the 2020 top 1000. You can see all 213 new brands by looking for the designation "new" in the Top 1000 list.

Top 25 biggest gains overall:

| Brand | 2020 | 2021 | Shift |

| Coach | 969 | 267 | 702 |

| Nestum | 915 | 224 | 691 |

| Macalline | 927 | 276 | 651 |

| Sinopec | 841 | 210 | 631 |

| China Unicom | 827 | 227 | 600 |

| JD | 852 | 291 | 561 |

| Petro China | 785 | 241 | 544 |

| Yunnan Baiyao | 955 | 421 | 534 |

| Taj | 965 | 447 | 518 |

| Baidu | 734 | 217 | 517 |

| State Bank of India (SBI) | 835 | 319 | 516 |

| Surf Excel | 910 | 400 | 510 |

| Redbus | 810 | 304 | 506 |

| China Auto Rental | 726 | 223 | 503 |

| China Merchants Bank | 854 | 366 | 488 |

| Life Insurance Corporation of India (LIC) | 994 | 512 | 482 |

| Airtel | 733 | 270 | 463 |

| MakeMyTrip | 818 | 367 | 451 |

| Jio | 738 | 293 | 445 |

| flipkart | 761 | 316 | 445 |

| Oracle | 967 | 534 | 433 |

| Paytm | 796 | 370 | 426 |

| SF Express | 744 | 324 | 420 |

| Haidilao | 547 | 136 | 411 |

Top 25 biggest drops overall:

| Brand | 2020 | 2021 | Shift |

| Wrigley's Arrow | 248 | 1000 | -752 |

| Thai Airways | 191 | 772 | -581 |

| Sunkist | 176 | 684 | -508 |

| Powerade | 238 | 733 | -495 |

| Spritzer | 479 | 970 | -491 |

| Skippy | 244 | 731 | -487 |

| Garmin | 369 | 854 | -485 |

| Shinhan bank | 362 | 845 | -483 |

| Tresemme | 495 | 964 | -469 |

| Doublemint | 150 | 612 | -462 |

| Google Play | 348 | 802 | -454 |

| Schweppes | 250 | 691 | -441 |

| Fitbit | 206 | 644 | -438 |

| Nestea | 201 | 621 | -420 |

| E Mart | 525 | 944 | -419 |

| Godiva | 262 | 680 | -418 |

| Super Nintendo Entertainment System (SNES) | 300 | 696 | -396 |

| Lucozade | 513 | 905 | -392 |

| Scott's | 519 | 896 | -377 |

| Rakuten | 287 | 663 | -376 |

| Nespray | 577 | 949 | -372 |

| GS Caltex | 454 | 816 | -362 |

| Perrier | 305 | 659 | -354 |

| Esprit | 647 | 994 | -347 |

| Tong Ren Tang | 494 | 836 | -342 |

Finally, here are the top 25 gains and drops for each of three broad tiers of the Top 1000: 101-250, 251-500 and 501-1000. While some of the brands here have already appeared above, you'll also see some other notable moves.

BY TIERS: 101-250

Biggest gains:

| Brand | 2020 | 2021 | Shift |

| Nestum | 915 | 224 | 691 |

| Sinopec | 841 | 210 | 631 |

| China Unicom | 827 | 227 | 600 |

| Petro China | 785 | 241 | 544 |

| Baidu | 734 | 217 | 517 |

| China Auto Rental | 726 | 223 | 503 |

| Haidilao | 547 | 136 | 411 |

| China Mobile | 571 | 165 | 406 |

| Lenovo | 582 | 189 | 393 |

| Ctrip | 609 | 219 | 390 |

| Industrial & Commercial Bank of China Asia (ICBC Asia) | 572 | 212 | 360 |

| Midea | 395 | 133 | 262 |

| Bank of China | 346 | 121 | 225 |

| Zalora | 425 | 247 | 178 |

| Tencent | 381 | 236 | 145 |

| Alipay | 257 | 120 | 137 |

| Nutrilite | 282 | 159 | 123 |

| Haier | 233 | 115 | 118 |

| MasterKong | 278 | 163 | 115 |

| Apollo | 220 | 110 | 110 |

| Telegram | 321 | 215 | 106 |

| Budweiser | 280 | 181 | 99 |

| Bosch | 297 | 198 | 99 |

| Nintendo 3DS | 328 | 240 | 88 |

| Big Bazaar | 252 | 166 | 86 |

Biggest drops:

| Brand | 2020 | 2021 | Shift |

| Air Asia | 38 | 204 | -166 |

| Nutella | 75 | 218 | -143 |

| Evian | 127 | 244 | -117 |

| Lipton | 52 | 154 | -102 |

| Nivea | 123 | 207 | -84 |

| Rolex | 45 | 127 | -82 |

| Sprite | 154 | 229 | -75 |

| Hugo Boss | 165 | 235 | -70 |

| Morinaga | 110 | 177 | -67 |

| Expedia | 126 | 192 | -66 |

| Pocari Sweat | 89 | 153 | -64 |

| Whiskas | 107 | 167 | -60 |

| Emirates | 161 | 213 | -52 |

| Del Monte | 85 | 134 | -49 |

| Casio | 142 | 191 | -49 |

| Avis | 185 | 233 | -48 |

| EPL / English Premier League | 114 | 161 | -47 |

| Agoda | 105 | 151 | -46 |

| Singapore Airlines | 129 | 175 | -46 |

| Traveloka | 192 | 237 | -45 |

| Pepsi | 106 | 149 | -43 |

| 100 Plus | 173 | 216 | -43 |

| American International Assurance (AIA) | 184 | 225 | -41 |

| Red Bull | 128 | 168 | -40 |

| Nintendo Wii | 133 | 173 | -40 |

BY TIERS: 251-500

Biggest gains:

| Brand | 2020 | 2021 | Shift |

| Coach | 969 | 267 | 702 |

| Macalline | 927 | 276 | 651 |

| JD | 852 | 291 | 561 |

| Yunnan Baiyao | 955 | 421 | 534 |

| Taj | 965 | 447 | 518 |

| State Bank of India (SBI) | 835 | 319 | 516 |

| Surf Excel | 910 | 400 | 510 |

| Redbus | 810 | 304 | 506 |

| China Merchants Bank | 854 | 366 | 488 |

| Airtel | 733 | 270 | 463 |

| MakeMyTrip | 818 | 367 | 451 |

| Jio | 738 | 293 | 445 |

| Flipkart | 761 | 316 | 445 |

| Paytm | 796 | 370 | 426 |

| SF Express | 744 | 324 | 420 |

| Indian Oil Corporation (IOCL) | 844 | 451 | 393 |

| Snickers | 689 | 302 | 387 |

| HDFC Bank | 717 | 349 | 368 |

| Nongfu Spring | 745 | 380 | 365 |

| Sagawa | 606 | 251 | 355 |

| Himalaya | 719 | 387 | 332 |

| ICICI Bank | 694 | 389 | 305 |

| Tata | 550 | 274 | 276 |

| iQiyi | 630 | 356 | 274 |

| Indian Premier League | 616 | 357 | 259 |

Biggest drops:

| Brand | 2020 | 2021 | Shift |

| The Body Shop | 168 | 442 | -274 |

| Tropicana | 134 | 392 | -258 |

| Mentos | 137 | 375 | -238 |

| Yves St Laurent (YSL) | 212 | 443 | -231 |

| Pantene | 125 | 354 | -229 |

| Seiko | 210 | 438 | -228 |

| Sunsilk | 200 | 422 | -222 |

| Arnotts | 230 | 434 | -204 |

| Purina | 266 | 465 | -199 |

| Minute Maid | 122 | 306 | -184 |

| Palmolive | 284 | 468 | -184 |

| Lux | 104 | 281 | -177 |

| Maxims | 293 | 467 | -174 |

| Bear Brand | 288 | 459 | -171 |

| Boss | 302 | 471 | -169 |

| Friskies | 242 | 408 | -166 |

| Standard Chartered Bank (SCB) | 331 | 495 | -164 |

| Gatorade | 121 | 277 | -156 |

| Acer | 203 | 359 | -156 |

| Dutch Lady | 180 | 326 | -146 |

| Mitsubishi Electric | 351 | 493 | -142 |

| Walmart | 335 | 476 | -141 |

| Head & Shoulders | 157 | 294 | -137 |

| Tylenol | 193 | 328 | -135 |

| Mead Johnson | 264 | 399 | -135 |

BY TIERS: 501-1000

Biggest gains:

| Brand | 2020 | 2021 | Shift |

| Life Insurance Corporation of India (LIC) | 994 | 512 | 482 |

| Oracle | 967 | 534 | 433 |

| Raymond | 913 | 507 | 406 |

| Bharat Petroleum Corporation Limited (BPCL) | 932 | 535 | 397 |

| Crest | 898 | 518 | 380 |

| K-24 | 990 | 617 | 373 |

| Lakme | 963 | 592 | 371 |

| Lactum | 980 | 627 | 353 |

| China Construction Bank | 978 | 675 | 303 |

| EQ | 909 | 608 | 301 |

| Mizuno | 945 | 667 | 278 |

| Unity Pharmacy | 870 | 595 | 275 |

| Farmina | 998 | 727 | 271 |

| Norton | 968 | 703 | 265 |

| Horlicks | 819 | 565 | 254 |

| Idemitsu | 925 | 671 | 254 |

| Aptamil | 935 | 687 | 248 |

| Blue Dart | 867 | 630 | 237 |

| Nitori | 801 | 569 | 232 |

| Kinley | 889 | 658 | 231 |

| Nissay | 958 | 737 | 221 |

| Boost | 833 | 623 | 210 |

| Moony | 756 | 556 | 200 |

| GAP | 923 | 725 | 198 |

| Air India | 746 | 553 | 193 |

Biggest drops:

This list is exactly the same as the list of the greatest drops overall (see above).