Source: 2021 Southeast Asia Consumer Engagement Benchmark Report from MoEngage.

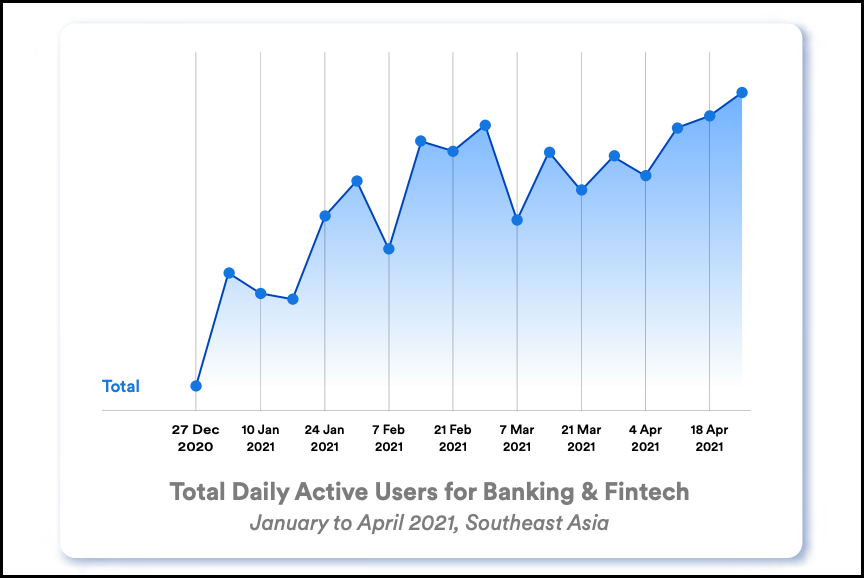

Methodology: From January to April 2021, MoEngage analysed the consumer behavior of 6.6 million users across Southeast Asia, primarily from Indonesia, Singapore, Malaysia, Philippines, Thailand and Vietnam, across three industry sectors: retail, banking and finance, and digital entertainment. The report looks at four communications channels: push notifications, email, in-app messages and website messages.

More from this source:

- In Southeast Asia, daily active users (DAUs) of ecommerce, retail and D2C brands increased by 13.36% in the first four months of 2021. When studying the monthly active user (MAU) trends of the same brands, web MAUs had increased the highest (by 8.7%) compared to mobile. This is likely due to pandemic movement restrictions and shoppers working from home, as opposed to shopping via mobile on the go.

-

The number of DAUs of audio streaming, video streaming, gaming, sports,

and news brands has increased by 61.70% from January to April 2021. There’s been an increase of 73.42% in DAUs on Android devices and a 47.80% increase in DAUs on iOS devices. The number of website DAUs of the brands in this sector has increased by 60.24%. - Behaviour-based emails saw better click-through rates and conversion across all industries as compared to the generic ones. Open rates of emails from shopping brands went up to 28.17% and the 0.5% of emails that were behavior-based in the digital entertainment sector saw a 2.4x better click rate, while in banking, behavior-based emails boosted conversions by 2.72x compared to generic broadcasts.

|

This article is filed under... Top of the Charts: Key data at a glance |