Covid-19 made $63 billion in spending disappear from the global advertising market in 2020, and a 6.7% forecasted improvement in 2021 will only recoup 59% of those losses, according to a new report from Warc.

Warc's Global Advertising Trends: State of The Industry 2020/21 report said that global spend will fall by 10.2% ($63.4 billion) to total $557.3 billion in 2020. This is a downgrade of 2.1 percentage points from Warc's previous global forecast of an 8.1% drop, made in May.

With the 6.7% growth forecast in 2021, the industry would need to grow another 4.4% in 2022 to get back to 2019's peak of $620.6 billion in spend, Warc reported.

If the $4.9 billion of advertising spend on the US elections were removed, the global ad market would record an 11.0% decline ($68 billion) this year. Warc also pointed out that in absolute terms, this year's decline is worse than the last recession in 2009, when the ad market contracted by $61.3 billion (12.9%).

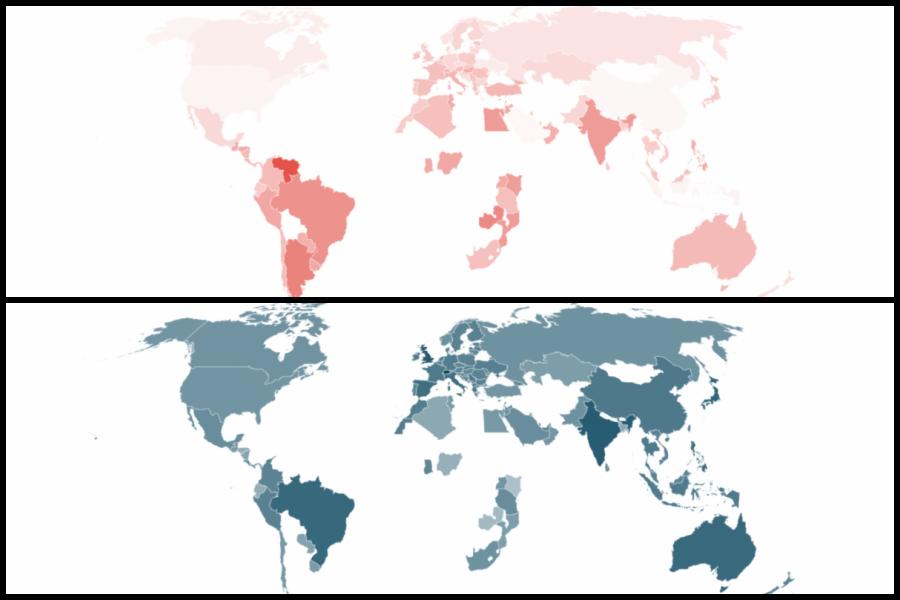

| Forecast by region | ||

| Region | 2020 | 2021 |

| Africa | -23.3% to $5 billion | 2.1% |

| Asia-Pacific | -9.7% to $174.4 billion | 8.5% |

| Europe | -14.5% to $127 billion | 10.2% |

| Latin America | -32.3% to $18.6 billion | Flat |

| Middle East | -20.2% to $11.3 billion | 7.0% |

| North America | -4.3% to $221.0 billion | 3.5% |

Worst year ever for traditional media

Traditional media accounts for nearly all of the decline in 2020, with global spend down by a fifth (-19.7%, $62.4 billion) to a total of $253.9 billion. Linear TV spending fell 16.1% ($29.9 billion).

The online advertising market—54.4% of the year's total—is flat (-0.3%) at $303.3 billion. This was the first non-growth year since the dot-com crash in 2000.

Cinema and OOH, two hard-hit forms of media in 2020, will be the fastest-growing formats in 2021, with cinema rising 41.2% and OOH 20.2%, Warc said.

Social-media formats were the strongest performers in 2020, recording total growth of 9.3% to $98.3 billion. The category will rise another 12.2% in 2021 to reach $110.3 billion, equal to almost a fifth (18.6%) of all advertising spend.

Online video is on course to rise 7.9% to $52.7 billion in 2020 and will grow by 12.8% in 2021. Paid search, which will decline slightly this year, will rebound with growth of 7.0% in 2021 to reach $130.6 billion—just over a fifth (22.0%) of all adspend.

Travel and automotive lead sector losses

Adspend within the automotive sector is down by a fifth (21.2%), or $11.0 billion, to $41 billion this year, meaning the sector is responsible for almost one in five (17.4%) lost dollars. Spending in retail fell 16.2% to $54.3 billion. The travel and tourism sector saw adspend drop 33.8% ($8.4 billion) to $16.4 billion).