CHINA's TOP 100 BRANDS: RANKING ANALYSIS

As the country first struck by the outbreak of COVID-19, China saw its consumption tumble at the beginning of 2020 year, just before our survey got underway. After the pandemic was under control, consumption returned, but with a major shift toward online.

Another factor looming over the consumer's mindset is the geopolitical tensions China is facing right now. In a country strongly influenced by collectivism, disputes with the international market will turn into a drive for domestic brands.

These trends clearly show in this year's list of the top 100 brands in China. Among the top 10 brands, Huawei made the biggest increase, moving up from 12th last year to fourth.

The surge is not surprising. Since the trade war started, the company has been targeted by the US government, but in China, Huawei is only expanding its influence. According IDC report, Huawei topped mobile phone shipments in China in the first quarter and its mobile-phone market share increased to 42.6%, top among all brands. It explains why Huawei overtook both Samsung and Apple in China.

WeChat is another brand that continues to solidify its place in Chinese hearts. It rose by three spots this year and is now in the 10th spot. With years of evolution, WeChat has become an omnipotent daily app for Chinese people. It is an instant messenger, an e-wallet, a social-media platform, an e-commerce platform...almost everything you can think of, you can find access on WeChat. The US and Indian governments view WeChat as a threat, and the Indian government already banned the usage of WeChat in the country. As with Huawei, these bans outside China may benefit WeChat thanks to a sense of pride. Recently, WeChat has been further developing its social-media functions, embedding a video-sharing platform in WeChat.

All across the top 100, many of the brands that rose by significant amounts this year were Chinese brands:

|

Within the top 100 list, those that lifted 20 places or more include:

|

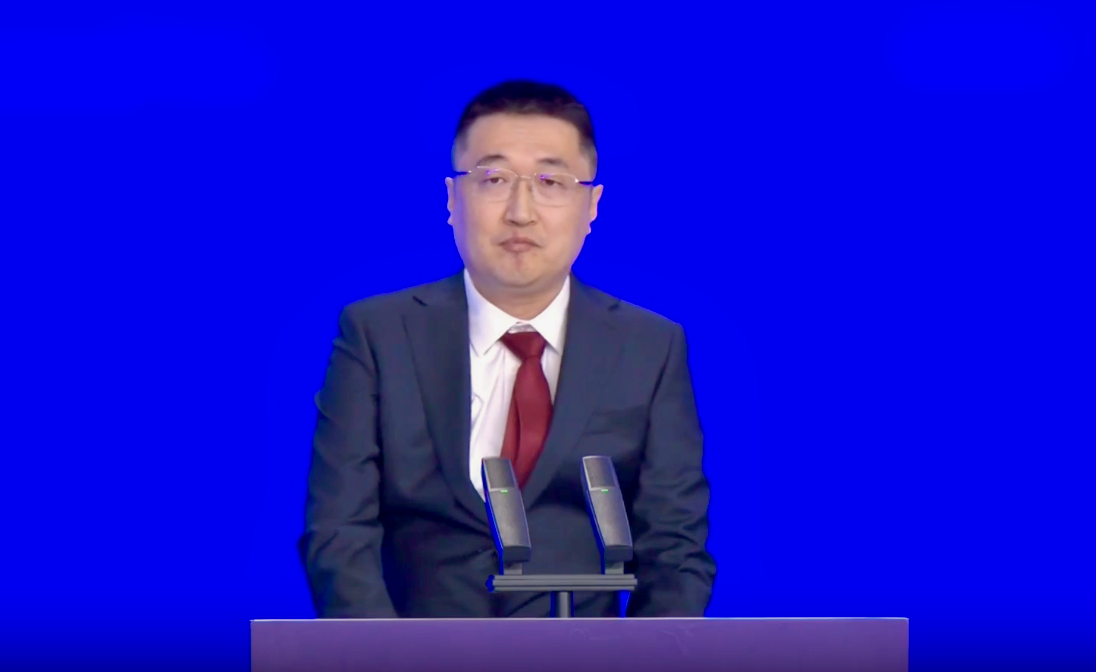

There is an eye-catching jump for Ctrip, the Chinese online travel agency. It moved up by an incredible 374 spots on the list this year. In a year with almost no travel, Ctrip has managed to keep its presence strong by actively helping the local tourism market. It was also one of the first companies to put its CEO on a livestreaming channel when the country closed down. And James Liang has proved to be entertaining and attention-getting, partly thanks to traditional and dramatic local costumes. The executives of Ctrip also actively spoke to the media on all relevant topics, keeping the name in the spotlight.

Those who fell

There are also some unexpected drops. Taobao, for example, slid 22 spots on the list to rank 61. The e-commerce platform is not only facing more challenges from rivals such as Pinduoduo, but fellow Alibaba subsidiary Tmall which is growing in recognition.

|

Within the top 100 list, those that fell 20 places or more include:

|

The most dramatic fall on the top 100 list is Sina, the Chinese media platform that runs Weibo. As part of the first generation of internet companies in China, Sina had its prime as a web portal. But when people's way of accessing the internet changed, Sina lost its place and its traffic volume. Only Weibo, its Twitter-like social platform, retains its former status. Weibo is still the go-to place when people and companies want to make official announcements.