Netflix doubled down on its original programming focus as it revealed impressive earnings and strong subscriber growth in Q3.

Total revenues of $5.25 billion were up 31 percent from the same period last year, the company stated in an investors’ letter on Wednesday. Meanwhile, net income was $665 million compared to $403 million in the prior-year quarter.

Membership growth this quarter rose considerably higher outside of the US, up by 6.3 million, a 23% year-on-year increase.

Netflix expects revenues to grow 30 percent to $5.4 billion in the final quarter of 2019. The news made shares jump more than eight percent.

"We did well during the first decade of streaming," the company wrote, addressing competitors flooding the market.

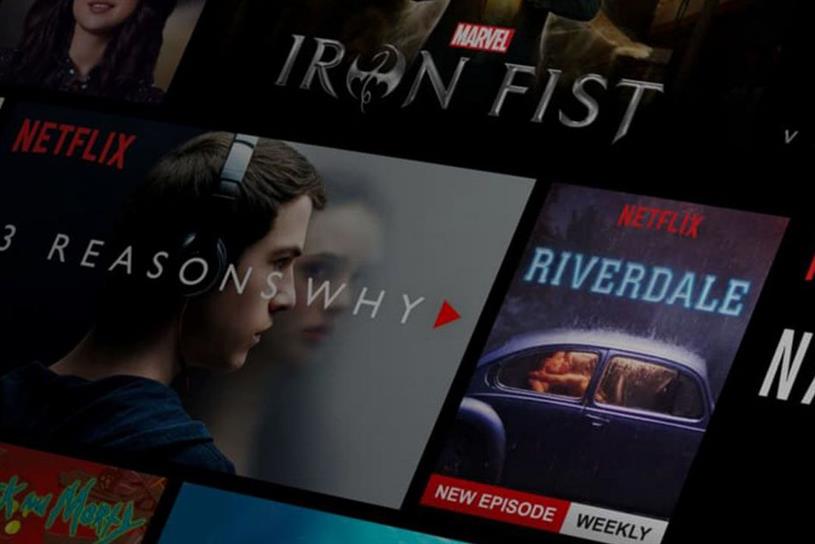

"We’ve been preparing for this new wave of competition for a long time. It’s why we started investing in originals in 2012 and expanded aggressively ever since -- across programming categories and countries with an ambition to share stories from the world to the world. In Q4, with The Crown, The Witcher, Klaus, The Irishman, The Two Popes, 6 Underground, and many other amazing titles launching, we’re ready to compete to earn consumers’ attention and viewing."

Netflix explained it competes broadly for entertainment time. This means there are many competitive activities to the service, from watching linear TV to playing video games. But it believes there is also a very large market opportunity.

Today, Netflix estimates it makes up less than 10 percent of TV screen time in the U.S. -- its most mature market -- and much less than that in mobile screen time.

Part of the letter read: "Many are focused on the ‘streaming wars,’ but we’ve been competing with streamers (Amazon, YouTube, Hulu) as well as linear TV for over a decade. The upcoming arrival of services like Disney+, Apple TV+, HBO Max, and Peacock is increased competition, but we are all small compared to linear TV.

"The launch of these new services will be noisy. There may be some modest headwind to our near-term growth, and we have tried to factor that into our guidance. In the long-term, though, we expect we’ll continue to grow nicely given the strength of our service and the large market opportunity."

Asian expansion

"While the new competitors have some great titles (especially catalog titles), none have the variety, diversity and quality of new original programming that we are producing around the world.

In its earnings release, Netflix emphasised the expansion of its non-English language original offerings which is pushing penetrations rates in international markets, which account for 90% of the service's growth.

Asia originals included The Naked Director, the biggest title launch in Japan, the second season of Sacred Games, our most watched show in India, and new Korean series Love Alarm. Netflix says it plans to expand our investment in local language original films and unscripted series.

It also highlighted the rollout of a lower priced mobile plan in India in Q3, noting retention has been better than initial testing suggested. Netflix said this would allow it to further invest in Indian content. Localisation of the service in Vietnamese and new bundles with KDDI in Japan were also listed among Q3 highlights.