Traditional players like Dentsu and WPP made 39 and 36 acquisitions respectively in 2016, with a combined estimated deal value of US$3 billion. However, all the activity from global holding groups represented just 22% of all transactions.

Increasingly, new entrants such as Vista Equity Partners, IBM, Snapchat and, most unconventionally, Chinese industrials like Nantong Metal Forging Group (南通锻压) and Miteno Communication Industrial Technology (梅泰诺通) are emerging to stake their claim in the marketing services sector.

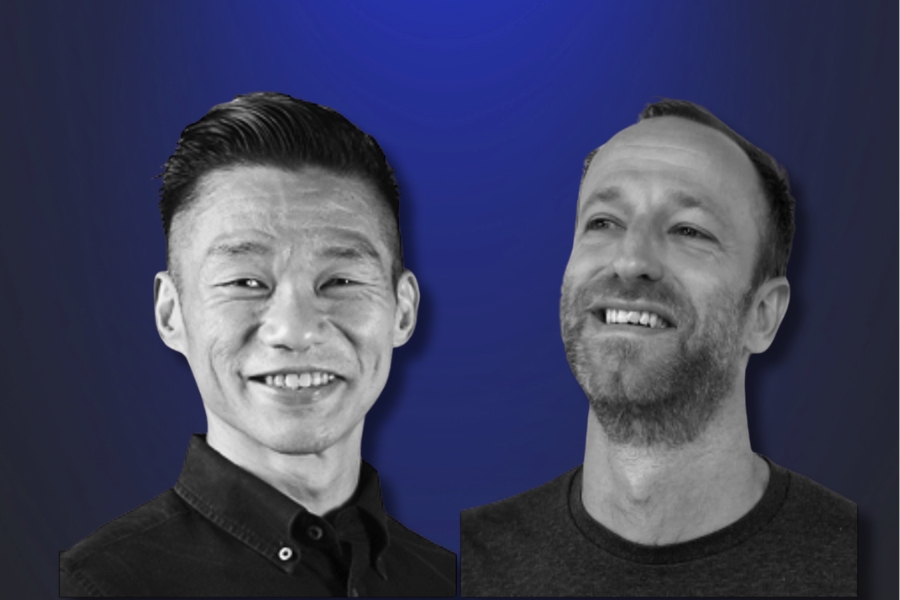

This increase was driven by more and more "asynchronous" buyers seeking out the best digital and analytic talent from outside their industries for future growth, said Greg Paull, R3's principal and co-founder.

In 2016, management consultancies got serious about expanding into marketing communications. Accenture spent US$175 million on Karmarama, Mobgen and IMJ; Deloitte invested into one of US’s boutique agencies, Heat.

The US market still led acquisitions with 50% of the value as well as 41% of the number of deals, while Asia Pacific remains the second ranked region. More acquisitions from Asia Pacific are expected in terms of volume, but transaction sizes will be smaller than in the US.

In fact, a new group of buyers including Facebook, Google and Amazon could become aggressive this year, Paull predicted.

“They have the cash, and they are continuing to take leadership roles on content creation, so the need for such talent will only increase,” he added.