Laura Ashton, a longtime APAC marketer, shared these observations with Campaign Asia-Pacific after a recent trip to North Korea. All photographs are Ashton's unless otherwise noted.

In a classic Merrie Melodies cartoon from 1955, a joyous, top-hatted dancing frog gets discovered in a demolished building’s cornerstone and later locked away again, only to emerge singing the same toe-tapping tune in the far future. A perfectly preserved time capsule. Such rare finds in the real world can teach us something of the thread that runs from the past to the present and on to the future.

For marketers in today’s omnichannel, always-on, data- and ROI-driven marketing landscape, such a perfectly preserved time capsule is North Korea. Advertising and the internet are essentially unknown and people are only just beginning to experience a late-90’s budding digital curiosity.

I recently spent a week in the Democratic People’s Republic of Korea (DPRK) with the Choson Exchange, where I volunteered to teach marketing and coach entrepreneurial skills to a group of 100 engineers and scientists from the State Academy of Sciences in the Unjong Park Special Economic Zone, 50 kilometers from the capital in Pyongsong.

Consumer marketing currently operates in the absence of advertising, of internet access and, generally, of knowledge of foreign brands. Yet consumerism and entrepreneurialism are on the rise. In this short article, I pry open the DPRK consumer marketing cornerstone to share my reflections on some CPG categories, packaging, promotion, pricing, premium retail and the fledgling ecommerce channel.

Politically, socially and economically isolated for decades, DPRK remains subject to strict international sanctions and there is virtually no exposure to foreign businesses and ideas. For citizens, even travel between cities requires a permit. The government network of ministries and institutes owns the land and buildings, the means of production, the market channels and provides employment. Interestingly, in recent years individuals have been allowed to create small businesses using the government premises and retain the profits for themselves. It is this tacit support for entrepreneurialism that stimulating the growth of small domestic businesses.

So what can a marketer see in the Hermit Kingdom?

Advertising

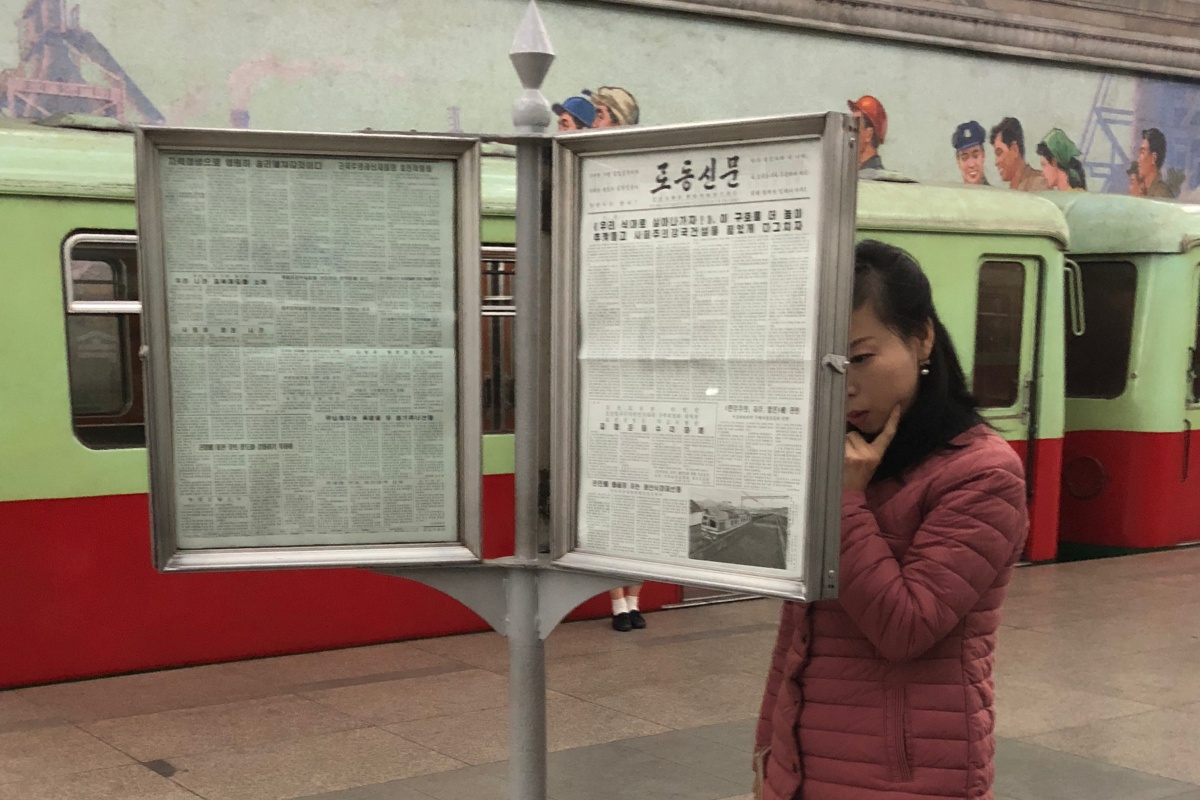

North Koreans have never been exposed to commercial advertising. Political propaganda posters and heroic monuments abound. The only two advertising billboards I saw in Pyongyang were for the same government JV automotive manufacturer: a tree-obscured car billboard on the way from the airport and another for minivans adjacent to our riverside hotel (below). The streets are all but empty of cars (except for the three-hour traffic jam we enjoyed during the Cuban President’s visit), so those billboards are more about pride and power than persuasion. The Korean newspaper, the Rodong Sinmun, whose title translates as “The Workers’ Newspaper” appears to carry no commercial ads, I noticed while watching commuters reading the daily on the subway station platform.

Retail categories, brands and sales promotion

In Kwangbok Department Store, where hundreds of locals and not more than a handful of foreign visitors were shopping, I was able to change some US dollars (or Euros or Renminbi) and pay in local Won. Incidentally, the official rate that applies in hotels, the airport and other official locations is 100 Won to the dollar. The unofficial rate, which we could have in the store, was 8000 Won to the dollar.

Photography was frowned upon, so I had to be discreet, hence the imperfect shots that follow. Only once was I asked to stop—while investigating some rather uncontroversial-looking pot noodles.

Global sanctions mean that the usual parade of international brands is unavailable. The vast majority of products are from North Korean government factories and, through the porous border, from China. There is the odd opportunistic listing, from Vietnam or Russia.

The frozen-in-time aesthetic that is associated with public propaganda posters has begun to disappear from product packaging. Elite consumers have a good choice of DPRK- and China-made products in reasonably modern packaging, sometimes copying the look of popular and aspirational South Korean brands.

Local production has in the past been done in joint ventures with Chinese companies, although as China is more respecting of sanctions, fewer of these are visible. Chinese investment is more surreptitious. For example, I was told that the supermarket we were in used to be overt about its Chinese JV status; now it has taken down the Chinese writing on the front. Given the continued importance of discreet cross-border trade, it would seem that China can be expected to have a disproportionate influence on the shape of branding and retail shopping until and after sanctions lift.

I was surprised to find shelves stocked with 26 brands of toothpaste, almost all from the DPRK, ranging in price from 4,500 to 25,000 Won. At the high end, ginseng and aloe vera varieties with attractive pack graphics aimed to appeal to local tastes and referenced traditional medicine. In this store, most of the more interesting varieties belonged to one of two manufacturers, Rainbow and Red Bird. Cheaper toothpaste options mimicked Colgate colours—although this nuance would be lost on consumers since international brands are simply not present. The range of choices and prices highlighted that even in elite Pyongyang—to say nothing of the rest of the country, home to 85% of the population—there is a significant gap between groups of consumers. Not something I had expected.

In the dishwashing, fabric care and feminine hygiene sections, there was a profusion of colourful packages, with brands from DPRK and China and one dishwashing brand, Apolon, from Russia.

In the China-dominated soya/seasoning sauces sections, some unofficially imported Maggi bottles from Vietnam were the only global brand on shelf. A Vietnamese brand also appeared in the disposable diaper section.

There were generally no promotional materials in the store: no shelf talkers, posters or sale signs.

Medical supplements were the standout exception. Customers shuffled through laminated A4 colour sheets extolling the features and benefits of various medicines and supplements that were spread across the glass counters of the pharma department.

Earlier, in a smaller shop selling supplements and ginseng products, I spotted large, full posters in Korean, Chinese, Russian and English making remarkable medical claims (ie, curing cancer, raising IQ, eternal youth, and so on). I didn’t check the prices, but they would have been cheap at any price—if they delivered on their promises! The same products were promoted on our international Air Koryo flights by flight attendants pushing trolleys along the aisle with product and posters, a practice that has been started just in the last year, I was told.

I expected to see and did see grocery sections with fresh meat, fish, eggs and dairy, but I was surprised by the selection of ready-made dishes. Multiple family incomes are common in the capital and time-poor Pyongyangites are increasingly able to buy freshly prepared convenience food from the department store. Chill cases were full that Sunday afternoon with clingfilm-covered foam deli trays of meatballs, seafood snacks and braised vegetables, many of them decorated with bits of parsley. My North Korean colleagues mentioned that dining out is an infrequent pleasure—enjoyed perhaps on a weekend or once every month or two. Take-away meals provide an occasional break or help add variety when family comes to visit.

I was slightly surprised by the abundance and apparent quality and would not assume that Pyongyang’s groaning shelves would be replicated anywhere else in DPRK, where millions of North Koreans do not have access to enough nutrition.

Later in my week in North Korea, we made a visit to the Golden Cup Foodstuffs confectionery factory in the outskirts of Pyongyang, not on the standard foreign tourist itinerary. A modern, multi-storey building with a high degree of basic automation, the factory produced snacks, baked goods and sports drinks. The latter were developed after Kim Jong Un saw some sports drinks officials brought back from overseas and requested that the factory reproduce them for Korean athletes and mass sale.

I asked the factory manager (the same woman who showed Kim around) about the process of securing listings in retail stores. In Pyongyang, two of the largest grocery stores, Department Store No. 1 and the Kwangbok Department Store, are run by different government branches. The Golden Cup factory, and its competitors, were also run by separate government entities. She explained that listings were granted on a priority basis when a manufacturer and retailer belonged to the same government unit. An attempted conversation about sales communication tactics and category management fizzled quickly.

E-commerce

While some of the scientists we worked with have controlled, daily access to the Internet for research purposes, even elite Pyongyang residents have never checked Facebook, posted an Instagram selfie, perused the bounty of Amazon or emailed internationally.

There is a domestic and intensely monitored national intranet that can be accessed by PC or mobile device. It is composed a few hundred mostly dull, brochureware websites and some basic online shopping, with and without fulfillment. For example, Man Mul Sang ecommerce (left, below) offered industrial generators and wristwatches—no category management yet!

Home intranet connection is possible, although the cost can be an impediment, especially for those living on high floors, and adoption is still at an early stage. However, mobile phones were common among our senior participants; they had older-style phones and a few Korean-made Arirang smartphones, all government approved, with no Bluetooth, WiFi or international dialling capability. Apparently some newer models are WiFi-enabled (although no GPS); Pyongyang just introduced WiFi zones in late 2018.

The most curious aspect of being digital in North Korea is the app store. There are apps: rudimentary games, books and e-commerce apps, but no chat, social media or OTT services. If you need an app, you go to the app store. Except in this case, the app store is a physical place where a staff member takes your money, plugs a cable into your phone and adds the app to your phone in person. When an update is released, you need to travel again to obtain it—and your original version is usually rendered obsolete until you do so. Several people I spoke to during the week told me that they were lapsed users of ecommerce and other sites because of the inconvenience of refreshing app versions. Sadly, our group was not able to visit to the app store.

The online space is certainly DPRK’s ground zero for an emerging advertising culture. Rudimentary online shopping exists through multiple platforms. The most basic are simply promotional sites, showing models, styles and variants. To buy, the customer needs to visit a physical store. Some sites are functional lists, like the Man Mul Sang screenshot above, featuring wristwatches and generators, devoid of category management. Others have more international-looking pages including imagery that begins to look like unimaginative Western catalogues or trade ads. Last-mile logistics has not been commercialised yet, so many sites include a phone number to the seller, who will arrange for delivery.

Conclusions

I expect that online shopping is where we will begin to see the rise of creativity and differentiation in DPRK. Outdoor advertising and in-store promotion is probably too public a declaration of openness for fledgling entrepreneurialism. Online, even heavily censored, brands can begin to develop. Let’s watch this space.

Chinese influence, through imports and joint ventures, in the North Korean B2C and B2B arenas is intense. At some stage, sanctions will begin to lift and international brands will arrive. In the absence of advertising today, Chinese brands may not be developing a strong position, apart from habit. If promotion is allowed when the market begins to liberalise, overseas brands—particularly those from South Korea—may be able to make a fast impact. Oddly, foreign brands who understand the power of digital marketing may, although late to the party, have a first mover advantage by knowing how to leverage brand, online.

What is clear to me is that choice, competition and differentiation will only become stronger. During the teaching and coaching sessions I had with entrepreneurs at the State Academy of Science, my DPRK colleagues’ interest in marketing strategy, product design, consumer insights, pricing strategy and visual examples from all over the world of B2B and B2C marketing was intense, and they wanted to apply it to their own nascent businesses.

The North Korean consumer marketing time capsule feels like pieces of Asia 20 to 30 years ago. The government involvement and supply chain infrastructure of China, the double currency of Myanmar, the inter-regional travel permits of Laos, the sudden enthusiasm for colourful, modern packaging of Thailand and South Korea and the tentative curiosity about online of, well, everywhere in the mid/late 1990s.

Change is happening. Quietly and unofficially, the North Korean government is letting the entrepreneurial genie out of the bottle. Like the genie, even as the international community considers the choices relating to sanctions, the amusing cartoon frog that represents consumer demand for more-better-cheaper, won’t stay in its cornerstone time capsules for long.

Laura Ashton is MD and chief client growth officer at Xunama, which bills itself as providing 'growth as a service' for startups. She has worked in APAC since 1990 on both the agency and client sides, including high-level positions with Saatchi & Saatchi, Shell, Electrolux, Philips, AT Kearney and Baker McKenzie.