YouTube’s ad revenue deceleration is gathering pace as it struggles to keep up with 2021’s “extraordinary” growth rates and a pullback in ad spend amid rising macroeconomic challenges.

The video streaming giant posted just 5% ad revenue growth to $7.3 billion in the second quarter of 2022, down from 14% in Q1 and a remarkable 84% growth rate in the same period last year.

Ruth Porat, the chief financial officer of YouTube parent Google, told investors on Tuesday (July 26) the “modest” year-on-year growth rate rate primarily reflects lapping the uniquely strong performance in Q2 2021. She warned that tough comparisons will continue to weigh on ad growth rates for the remainder of the year.

YouTube’s quarterly decline in growth reflects pullbacks in spend by some advertisers, Porat said, but she did not break down specifics or detail which ad sectors are being impacted. Porat said the pullbacks reflect “uncertainty about a number of factors that are challenging to disaggregate.”

Russia’s war with Ukraine, which resulted in a decline in ad spend from European advertisers in Q1, was a “modest headwind” in Q2, while Apple’s ATT framework remains a constant challenge, Porat said.

Google’s chief business officer Philipp Schindler sought to temper concerns about YouTube’s prospects by pointing out investments in its full-funnel capabilities, “encouraging” early tests of YouTube Shorts monetisation and “pleasing” commitments made during YouTube’s first upfront season this year. Again, the company was light on specifics.

YouTube Shorts, the platform’s TikTok-like short video offering, now clocks 1.5 billion logged in users every month, the company said.

Google’s network revenue of $8.3 billion, which is revenue it generates from selling ads outside of its own properties, also witnessed a slowdown in its growth rate to 9% from 20% in Q1.

Search ad revenue grew 13.5% to $40.7 billion, exceeding analysts’ expectations of $40.15 billion, but this also represents a deceleration from Q1’s 24% growth rate.

Google’s total advertising revenue grew 12% to $56.3 billion in the quarter ended June 30, 2022.

Slowing hiring and sharpening focus

Parent company Alphabet’s total Q2 revenue rose 13% year-on-year to $69.7 billion in the quarter but net income fell 14% to $16 billion.

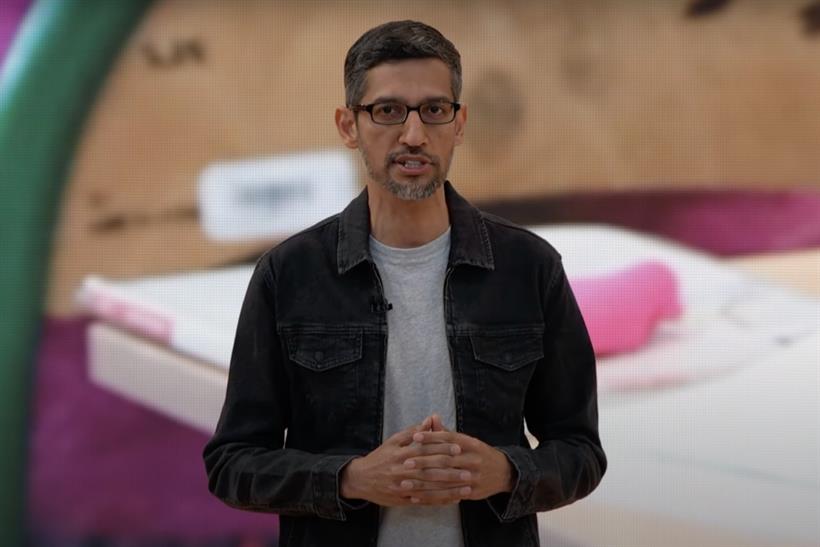

Alphabet and Google CEO Sundar Pichai told staff earlier this month the company was slowing hiring and sharpening its focus in the face of an “uncertain global economic outlook.”

Artificial intelligence and cloud were called out as “critical areas” for long term growth on Tuesday’s call with investors.

“As I said to the company, it is a good time to sharpen our focus. Personally I find moments like these clarifying,” Pichai said. “It gives us a chance, given a few years of strong growth, to double down and focus. We are going to be disciplined with how we approach it but our focus on the longterm areas, be it AI and cloud and other critical areas, will continue.”

Google’s cloud revenue lifted 36% in Q2 to surpass the $6 billion mark, but its operating loss enlarged to $858 million from $591 million the prior quarter. Porat said the company needs to balance investing to support long term growth with profitability. The largest investments Alphabet made in Q2 were in servers and data facilities.

Alphabet added 10,108 employees in Q2 but it said it intends to slow the pace of hiring for the rest of the year and focus more sharply on “engineering, technical and other critical roles.” It has 174,014 employees worldwide.