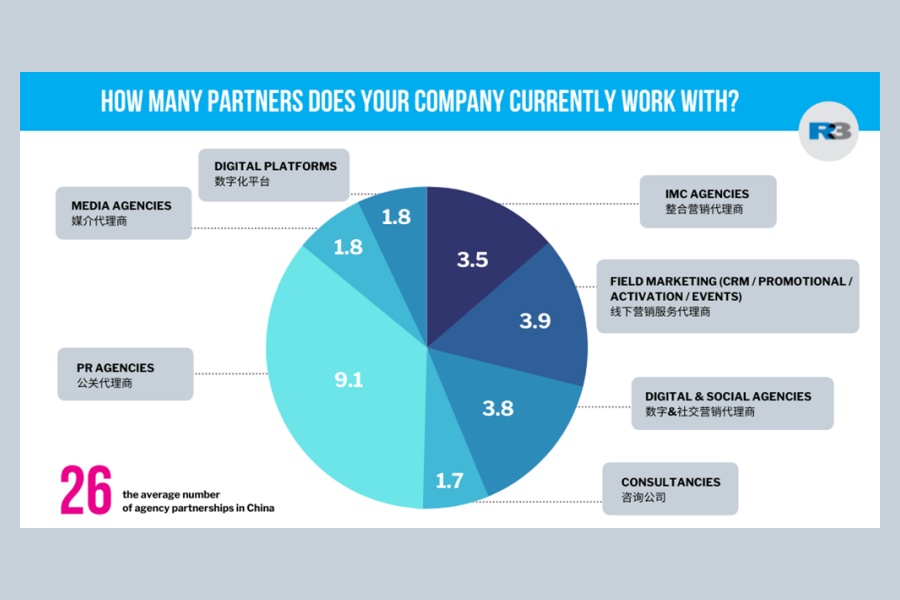

Source: Agency Scope China 2021/2022, by R3 and Scopen, which looks at trends within marketer-agency relationships and the perception and image of agencies. The research included interviews with professionals from 208 different companies in China, with over 890 client-agency relationships analysed.

More from this source:

- 81.7% of China marketers in the study prefer to work with an ecosystem of specialized agencies, with only 15.6% currently working with a single agency model.

- 68.8% of respondents named ecommerce as a key scope of their work and essential to sales conversion, followed by social CRM (65.8%) and online video platforms (55.4%).

- 66.2% of marketers are satisfied with their current agency partnerships, making China one of the most demanding markets when it comes to agency satisfaction.

- Leo Burnett, Ogilvy and BBH rank in the top three when it comes to agency performance.

|

This article is filed under... Top of the Charts: Key data at a glance |