Each year when the Asia's Top 1000 Brands data arrives from Nielsen, one of the first things we do is put our Excel skills to the test to compute which brands have moved the furthest up or down.

However, simply looking at the biggest moves is a bit random and narrow. It misses a lot of significant brand accomplishments (or failures). Why? Because after you stare at the data long enough, it becomes clear that big moves are more common the further down the list you go. While jumping (or plummeting) by triple digits is common in the lower reaches of the list, moves of 10 positions or more among the Top 100 are relatively rare—and therefore speak to statistically significant changes that should be highlighted.

With this in mind, we're proud to present a more in-depth and (though we detest the word) 'granular', look at the brands whose fortunes rose or fell this year. The captions will tell you what you're looking at as you go through the image gallery above, but here's a map to what you will find:

- The Top 100: This section shows all the brands from the Top 100 which rose or fell by 10 or more positions (only three went up and eight went down).

- Biggest gains (overall): This section shows a selection of the most eye-popping positive numbers from anywhere in the entire Asia's Top 1000 Brands list.

- Biggest drops (overall): As above, but this time it's a selection of the most distressing drops from the entire list.

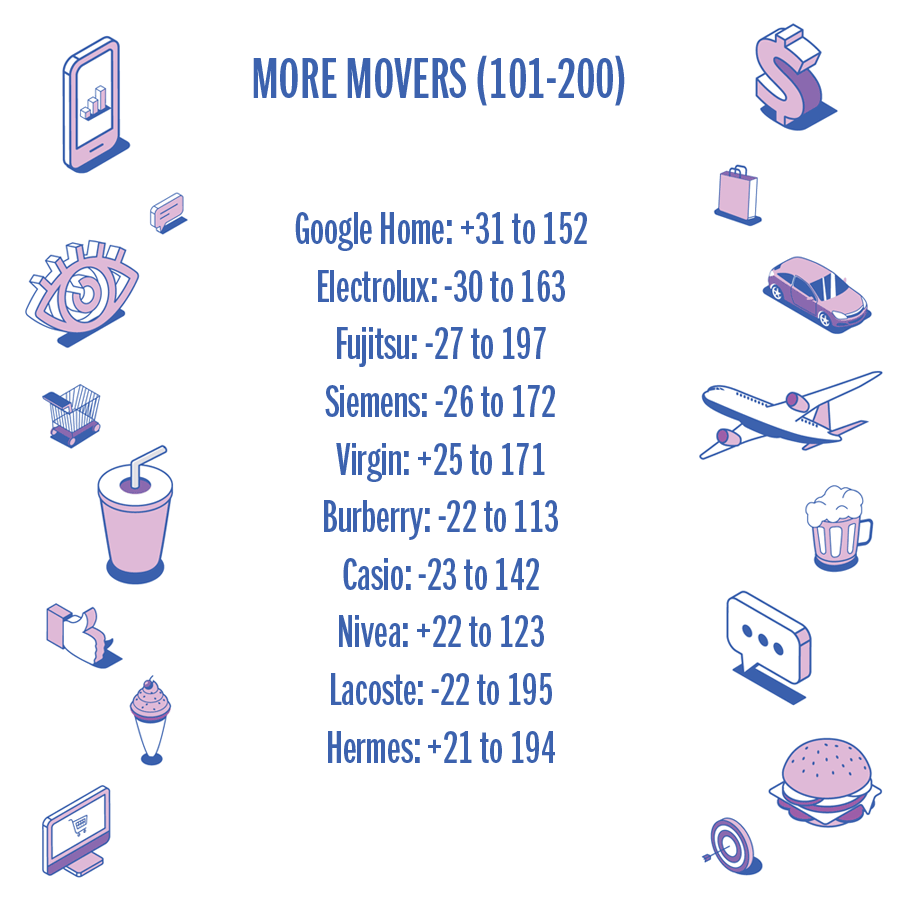

- The second 100 (101-200): A selection of the biggest gains and largest drops in this tier (excluding those already cited in the 'overall' sections).

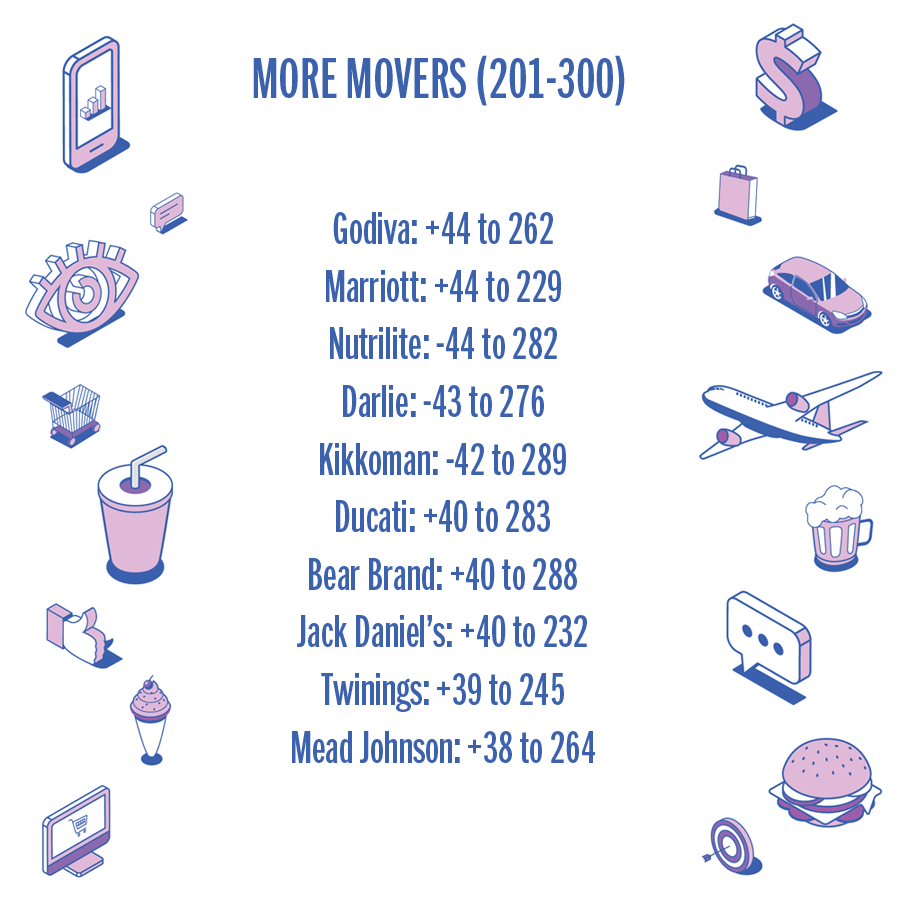

- The third 100 (201-300): As above.

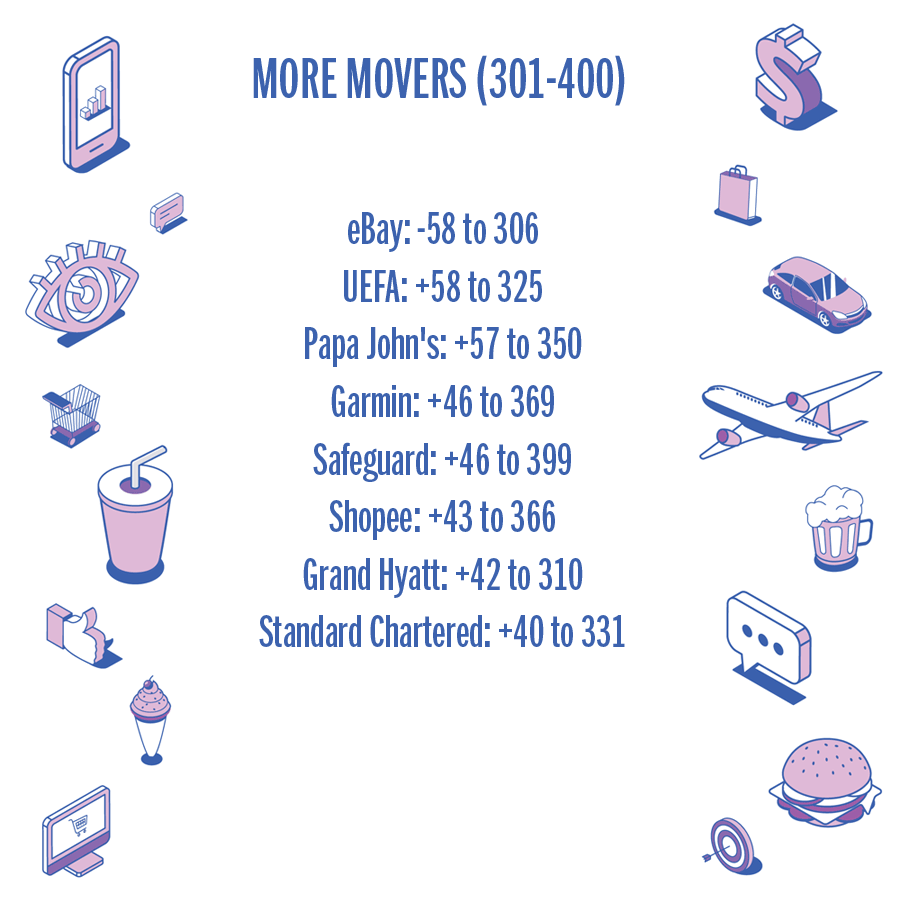

- The fourth 100 (301-400): As above.

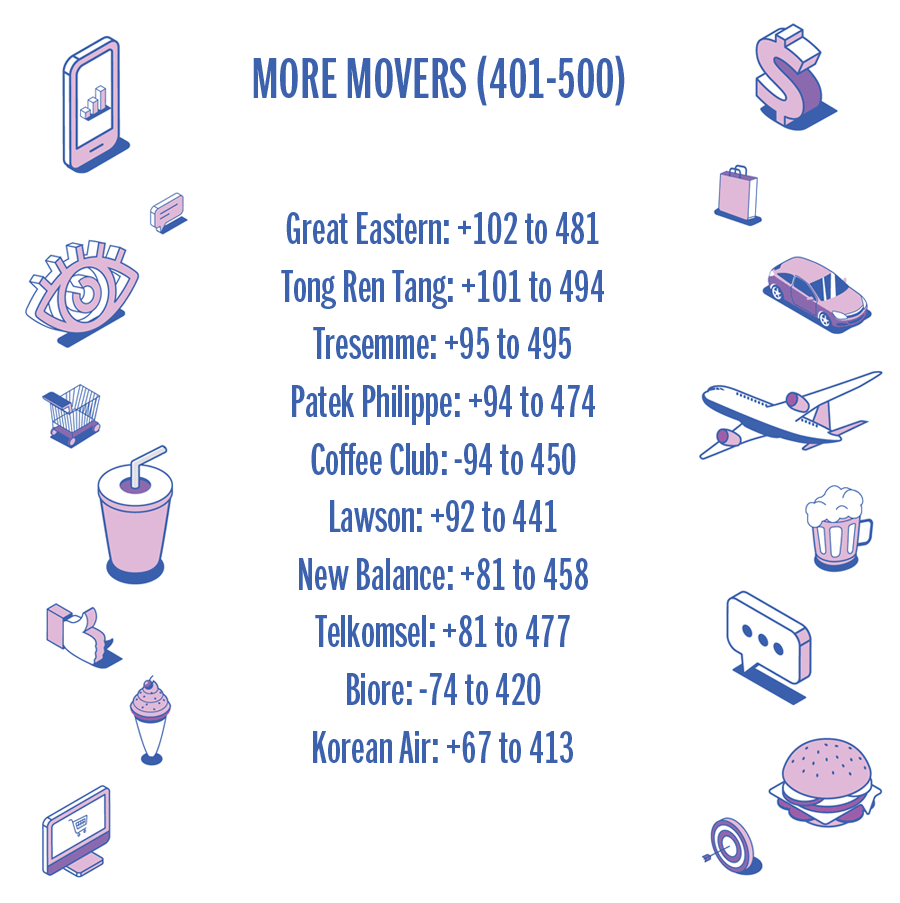

- The fifth 100 (401-500): As above.

A final note in case you wonder: In each of the tiers except the Top 100 (where we're showing all the brands that moved by more than 10 spots), we've highlighted just a selection of the biggest moves up or down rather than providing an exhaustive list. In some tiers, you'll see an even number of risers and droppers, but in some tiers, for whatever reason, there were more moves in a particular direction. For example, in the 401-500 tier, most of the big moves were gains.

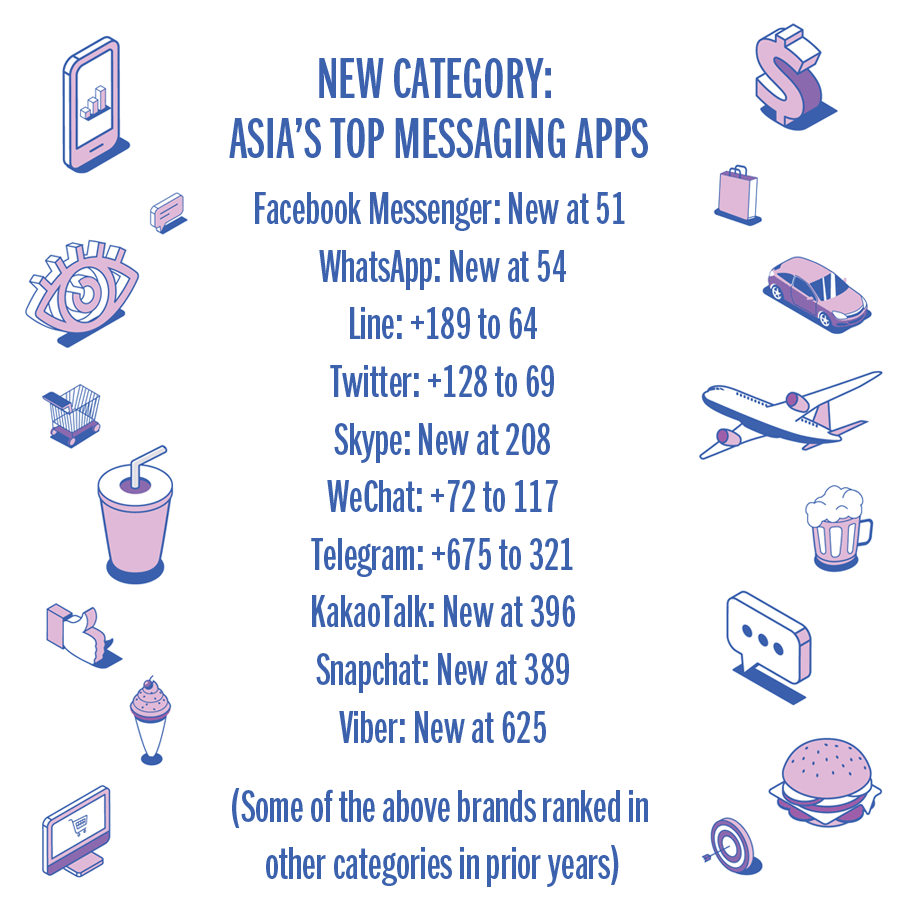

Bonus: The last slide in the gallery shows the top brands in a new sub-category we added this year within the Media & Telecommunications category: Asia's top messaging services. Some of the brands here show up for the first time (because this is the first time we've asked people to name messaging services) whereas others were already present because they'd ranked within the top 1000 in prior years in other sub-categories, such as social-networking sites. You can read a further analysis of the new category here: "Facebook Messenger pips WhatsApp in consumer's minds".