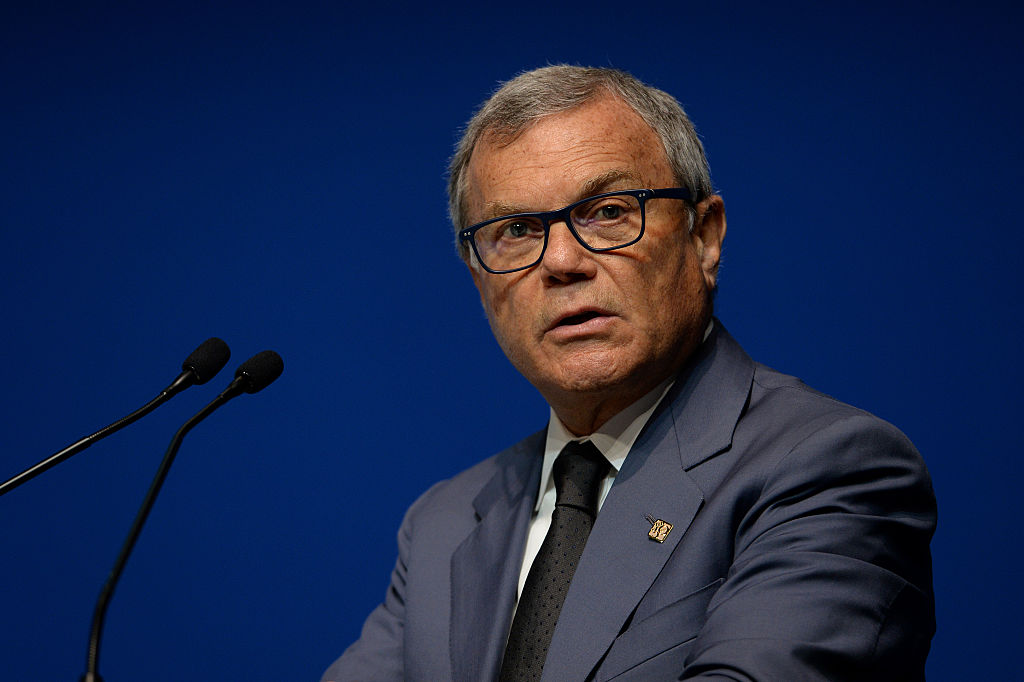

Sir Martin Sorrell is remarkably optimistic about his advertising business during COVID-19, despite likening the impact of the global pandemic as "closer to a world war" than a recession.

That's coming from the executive who steered WPP through the financial crash of 2008, among other events.

Indeed, Sorrell believes the virus outbreak—which has forced many countries into lockdown resulting in dramatic overnight shifts in consumer behaviour—opens up "tremendous opportunities" for his own marketing services company, S4 Capital.

"I think we will gain as a result of this, not necessarily in the short term, but in the medium to long term," he tells Campaign Asia-Pacific.

The positive impacts he details are three-fold: a growth in the online consumer base, an acceleration of media shifting online, and an acceleration of digital transformation projects at an enterprise level. All trends that stand to benefit his four-year-old content and programmatic practice (Sorrell's description, it is definitely not an agency or an agency network), which is "purely digital" and counts technology clients as half its client base.

But others will not be so lucky. In fact, advertising's big six holding companies—including the one he stewarded for 33 years before his controversial exit in 2018—are in "deep doo doo".

In his view, holding companies are "too big" and "lack focus", problems that he believes are fatal in the current economic climate.

"The six holding companies [WPP, Omnicom, Publicis Groupe, Interpublic, Dentsu and Havas] are really in deep doo doo because they can't get away from their analogue businesses," he opines. "If you're an analogue business, you have to reposition yourself rapidly. You have to blow things up."

"It's the old cannibalisation argument: if you don't eat your children, somebody else will," he goes on. "In this case, if you don't change your organisation, it's going to change for you, it's going to be out of your hands."

Their hamartia is an imbalance of power at the very top, he believes, with traditional creative directors being paid far bigger salaries (he estimates a top New York CD could feasibly be on a $4-5 million/year salary package) than digital directors (he estimates $250,000/year).

"The forces are keeping the costs high in the traditional business when the revenues are declining quite rapidly," he believes.

Sorrell has grown S4 Capital by acquisition, in core specialties of content (MediaMonks, Caramel Pictures, BizTech, IMA, Firewood, WhiteBalance, Circus Marketing), programmatic (MightyHive, ProgMedia) data and analytics (Conversion Works, a Korean firm called Delicious Data*). Focusing on these core specialties is what makes S4C unique in Sorrell's eyes. He believes its only direct competitor is French holding company Fimalac, which bought a majority share in UK-based Jellyfish in November, a digital shop that he says he was considering investing in around the same time S4C bought MightyHive.

Holding companies may claim to offer these specialties, but their "execution is lacking". He says the closest thing WPP could get to being a direct competitor to S4C would be an amalgamation of its digital agencies AKQA and Essence with its market research firm Kantar (which it sold 60% of to Bain Capital last year).

Sorrell goes on to liken S4C to the Tesla of the advertising industry: "It's a bit like saying, why is it that the car companies can't compete with Tesla or why is it that the banks can't compete with fintech companies? Often they're so big they can't get out of their own way."

With this in mind, he imagines the financial pressures of COVID-19 will lead to a "Darwinian cull" of the weakest links in advertising—with holding companies forced to either go private and break up, or break up publicly.

"This challenge from C19 is going to unleash tremendous energy," he says. "It's a bit like pruning a tree. I mean, it's a terrible analogy because there's a tremendous human cost here, but there's a Darwinian cull...that I think is going to happen."

How COVID-19 has affected S4

Having a technology-heavy client base means S4C may not be feeling the same pain as other ad groups. While many brands have dialled back ad spend during COVID-19, some of S4C's technology clients are "spending more money" now, Sorrell claims.

"The tech companies are much more solid in terms of their budgets. There is some switching from H1 to H2, money is being moved because there's pressure—I think it's the small-to-medium business pressure," he said. "But so far, I would say, marginal actions."

Non-tech clients are cutting budgets, he acknowledges, but cuts have been targeted at "traditional" advertising such as linear TV while more money is being spent on digital to drive short-term sales, he claims.

"The sales side is being delivered by more measurable, cheaper, more effective CPMs and performance on the digital side," he says. "That's the big shift that we're seeing."

With programmatic, data and analytics purportedly representing 30% of S4C's business (content makes up the remaining 70%), Sorrell is confident it is well-positioned to capitalise on these shifts in client behaviour.

"I think we're in the fortunate position that we can describe [to employees] a future which has got promise in it," he said. "Others may have much more difficulty in doing that, but because of the way we're positioned, I think we will gain as a result of this." He caveated this with an acknowledgment that the "human cost will be huge".

S4C has also been "pitching aggressively" during COVID-19 and "getting some very good results", including winning a major FMCG account and pharmaceutical account in the last quarter, Sorrell said. The two accounts were previously with holding companies, he added.

Consequently, S4C, which made £215.1 million (US$267 million) in revenue in 2019, has so far seen its financials "marginally affected" by COVID-19.

"We have no leverage, we have good liquidity, and we are well breached from a facilities point of view," Sorrell said. He claims the group had a "very strong January" but began to see "a little bit of effect" from February. Liquidity and payment terms are among the chief financial concerns he has.

As the first region hit by COVID-19, Asia-Pacific took the biggest revenue hit in Q1, but this region represents just 10% of S4C's business (although Sorrell hopes to up that proportion to 40%). North and South America are its biggest regions, representing 70% of its business, with Western Europe making up the remaining 20%. The pandemic only began to take hold of these regions from March, so this will likely weigh down Q2 for many businesses.

Indeed, Sorrell predicts Q2 is going to be a "disaster" for the industry, but remains "bullish" it will see a recovery "if not in all, in many segments" by Q4.

Changes to working practices

Sorrell reveals he is one of eight leaders within S4C to have taken a 50% salary cut from April 1 "as a strong signal to the organisation what we're prepared to do". No other members of staff have been given pay cuts, as of yet, and the business has "reduced but not frozen" its level of hiring.

The eight senior leaders formed a "coronavirus crisis group" in February and have been meeting daily to discuss how to handle the management of staff, clients and finances (in that order, Sorrell assures) during the crisis. His strategy as a leader has been to "over communicate" to staff, by updating them weekly on health and safety and how the business is faring.

It has been "extraordinarily lucky" to have recorded very few internal cases of COVID-19—Sorrell recalls four cases out of a 2,500 workforce.

Working practices have not been impacted by the transition to working from home since the business is "purely digital" anyway, Sorrell says.

"I get physically affected when people start to waffle on about how amazing it is that people are working from home," he says. "For digital natives working from home is part of their work."

In fact, he says the company has dealt so well with the shift that it may become a permanent fixture— with the company beginning to cut its property leases.

"We're already cutting our leases, not just because we want to reduce those costs in C19 although that's part of it, but because we see a distinctive change in the pattern of working, and our people are saying that they prefer working from home," he says.

He envisions being able to re-invest the $35-40 million it currently spends in property back into its people, "which is, after all, our business".

Pandemic 'will not stop us expanding'

Sorrell is still aiming to double the size of S4C organically excluding deals within three years. Inspired by Facebook's recent investment in India's Reliance Jio, he said the pandemic is "not going to stop us expanding the business", and is eyeing expansion in its data and analytics capabilities in Asia-Pacific and Latin America, plus an outpost in Germany.

"We're not going to do things at scale, we're going to do things which are manageable and which will not impact our balance sheet negatively as we think short term financial strength and the balance sheet is critically important," he noted.

*It was reported at the time that MightyHive had acquired a Korean firm called Datalicious. Due to trademark issues, MightyHive then issued a correction to the announcement. It has since changed the name of the firm to MightyHive Korea. This article was updated to change the Datalicious reference to Delicious Data.