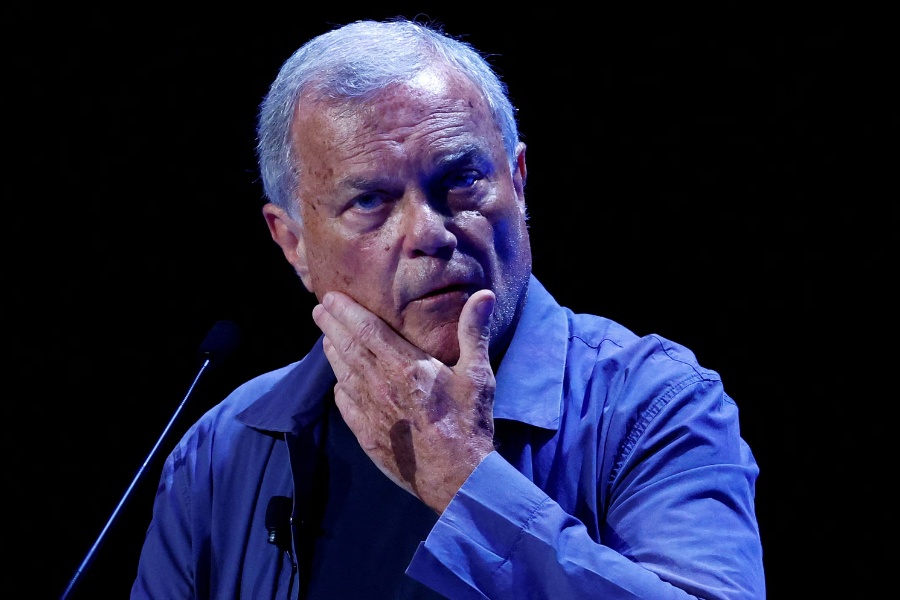

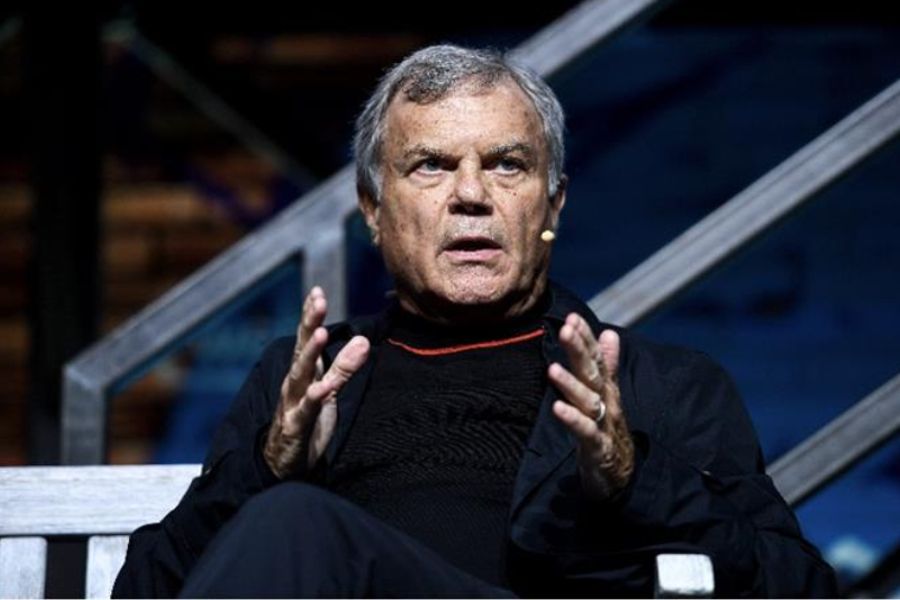

Sir Martin Sorrell’s S4 Capital has reported a 15.4% year-on-year decline in net revenue for Q3, “reflecting lower activity in content and data and digital media”.

Total net revenues for the quarter were £211.5m, compared with £249.9m for the same period last year. However, while revenues from content and data and digital media dropped by 20.4% and 14.2% respectively, technology services grew by 6.6%.

Billings including pass-through costs were £450.3m in Q3, down 7% on £484.2m in the same period in 2022.

By region, net revenue fell 14.5% in the Americas in Q3 to £167.6m and by 18.9% in EMEA to £30.4m. It dropped by 17.2% in Asia-Pacific to £13.5m.

For the first nine months of 2023, net revenues were up 5.1% year on year to £657m and billings up 8.8% to £1.38bn.

By region over this period, net revenue grew by 8.5% in the Americas to hit £521.3m but dropped 4.3% in EMEA to £96.5m and by 10.5% in Asia-Pacific to £39.2m.

Sorrell described Q3 as “difficult”, with “continued client caution”, but he said like-for-like growth at the company’s top 20 clients was up 2.9% in the year to date, and with the top 50 clients it was up 4.6%.

He said he expected Q4 profitability to be the strongest of the year, boosted by the usual seasonal activity and artificial intelligence initiatives and use cases, “along with the actions taken on cost management”.

S4 said there were 8,187 people in the firm at the end of Q3, compared with 8,551 at the end of the first half of 2023 and 9,041 in June 2022 – a 9% drop overall.

The company said this was “reflecting the progress that has been made on aligning our cost base to the demand we are seeing from our clients.

“Further actions are being taken in Q4, with significant focus on managing our cost base and driving efficiency across the company.”

In its half-year results S4 Capital said it had cut about 500 jobs, describing a “disciplined approach to cost management”.

S4 said it expected like-for-like revenue for 2023 to be lower than last year, with an operational Ebitda margin of about 10-11%.

In early trading, the company’s share price dropped by about 9%.