Digital advertising’s fraud problem is only growing as more money shifts online.

Marketers will collectively lose $35 billion to ad fraud this year, up 17% year over year, even as digital ad spending decreased during the pandemic, according to a report from verification company Cheq and economist and University of Baltimore professor Roberto Cavazos. The study analyzed trillions of transactions made monthly across 15,000 businesses.

That $35 billion figure puts the money lost to fraud in digital advertising, a $333 billion industry, higher than money lost to credit card fraud, a $3.32 trillion industry. That’s in part because the digital ad industry doesn’t have as many safeguards and regulations around fraud as more established sectors.

But it’s also because digital ad fraud is extremely complex and involves multiple players with competing interests. And there’s constant innovation with new types of fraud that continue to crop up as media fragments, said Guy Tytunovich, CEO and cofounder at Cheq.

“If there are suddenly new platforms no one even imagined a few years ago, we're going to see upticks in fraud,” he explained.

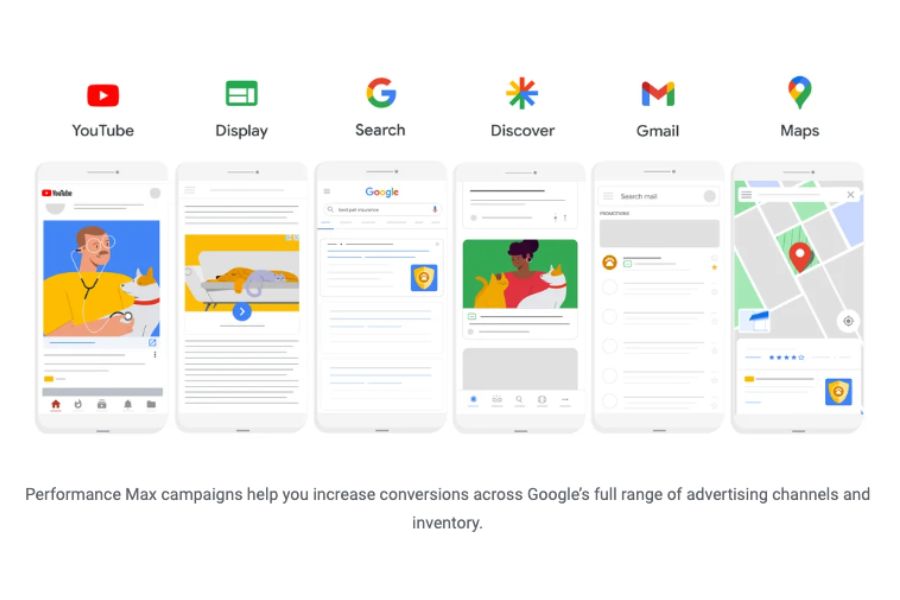

For example, marketers are expected to lose $4 billion to OTT fraud this year as investment grows to $23.8 billion and more transactions are made programmatically. Time spent watching OTT is expected to grow 81% to roughly 4 billion hours per week, per Cheq, creating more inventory to manipulate. OTT also commands higher CPMs, and fraudsters follow the money.

“Connected TV became huge even faster than expected this year,” Tytunovich said. “It’s not really a space that's been learned extensively by agencies, vendors and measurement companies.”

Fraud also continues to be persistent in mediums such as display and on mobile, where advertisers lose an estimated $4.8 billion annually, typically through malware.

About 14% of paid search and social spend is invalid as well, largely driven by click fraud. E-commerce sites are most vulnerable to click fraud, and are set to lose $3.8 billion in 2020, Cheq found.

“This is something we've seen in the past but not remotely close to what we saw in 2020,” Tytunovich said. “My only explanation is there was a huge uplift in e-commerce activity because of COVID.”

Covid + election = the perfect storm

Fraud tends to rise during recessions, and the COVID-19 downturn is no exception.

About 9% of publisher page views were fraudulent between April and June of this year. Small businesses were particularly hurt by click fraud, which rose 21% across paid search campaigns during lockdowns.

“Fraudsters typically smell a crisis as an opportunity, and jump on it,” Tytunovich said.

Bad actors also saw an opportunity to game the influx of political ad spend this year, set to reach $1.3 billion in light of the presidential election. Between 10% and 30% of political ad spend is typically wasted on fraud because these teams don’t have the incentives or resources to monitor fraud.

“There's a lot of competition for eyeballs not just between Democrats and Republicans, but other advertisers,” Tytunovich explained. “So the bids go up and the ads become more lucrative.”

While digital advertising’s fraud problem will only continue to grow along with digital ad spend, there’s evidence that the industry is doing a better job of mitigating the issue. Plus, there have been more legal actions taken against fraudsters this year, demonstrating that regulators are waking up to the issue.

“There's more investment now than ever before across the board,” Tytunovich said. “The risk has become a tiny bit bigger for fraudsters in terms of being held legally accountable.”