Ad spend in Asia-Pacific is expected to reach US$162.4 billion this year and to continue growing at a CAGR of 9.4 per cent to overtake North America in 2014, according to a report by eMarketer, in collaboration with Starcom MediaVest Group (SMG).

eMarketer's Global Media Intelligence Report predicts that China is set to become the world’s second-largest advertising market in 2013, and the second-largest digital advertising market the following year, behind the US. As a result, Asia-Pacific is expected to surpass North America in total ad spending in 2014, thanks to extraordinary growth rates in internet and mobile internet usage, as well as rapid growth in digital advertising spending.

In 2016, Asia-Pacific's projected ad spend is expected to reach $232.8 billion, followed by North America's projected ad spend for that year of $204.6 billion, said the report. (All figures are in US dollars.)

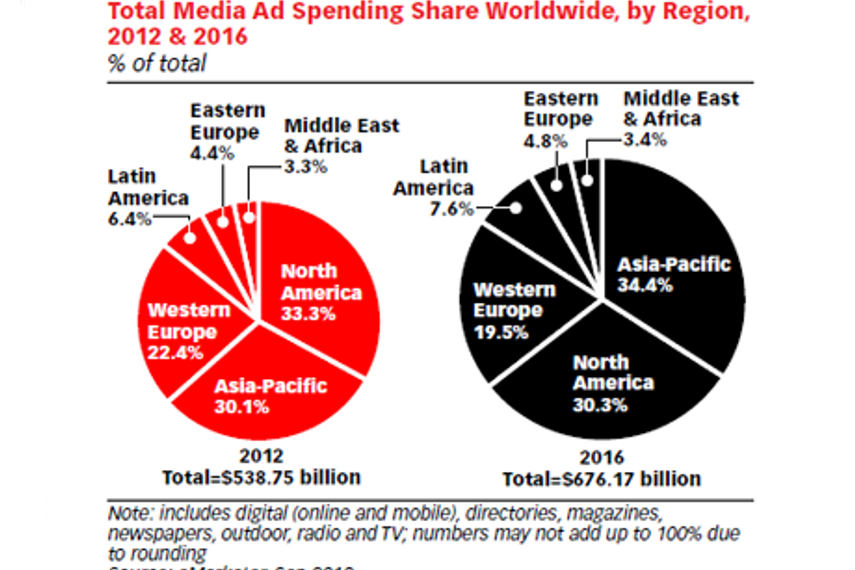

This would garner Asia-Pacific 34.4 per cent of the global ad spend pie, compared with North America's share of 30.3 per cent in 2016, said eMarketer's Global Media Intelligence Report.

This year, Asia is expected to account for 30.1 per cent of global ad spend, which is forecast to top $538 billion. That would make Asia the second strongest performing region after North America, which is projected to account for a third of the pie. Based on eMarketer's estimates, global ad spend in 2012 will be 6.8 per cent more than last year.

As expected, the fastest growing media category is digital advertising, which is expected to continue to outperform all other categories until 2016. Advertising designed for mobile devices is a particularly strong compomnent of the digital spend.

This year, global digital ad spend is forecast to top $105 billion, with Asia-Pacific accounting for $27.63 billion after North America ($40.3 billion) and Western Europe ($28 billion).

By 2016, eMarketer expects digital ad spend to be about $173.2 billion and Asia-Pacific to overtake Western Europe with an ad spend of $53.2 billion.

As shifting audiences draw a greater share of the budget to digital ad spend, advertisers can increasingly make use of digital options to refine and amplify the effect of their activity on most traditional advertising platforms, recommended eMarketer. “For example, TV and out-of-home advertising have been reinvigorated by the potential for cross-channel interaction, in real time, with online and mobile marketing,” the report stated.

This won't hold true in all parts of the world, however. According to the whitepaper, many regional variations in usage will not be dispelled by advances in media penetration. “The media habits of semi-rural residents in India and Brazil will never mirror those of the cosmopolitan crowds in San Francisco, Munich or Dubai,” it said.

This year, the US ($37 billion), Japan ($9.6 billion) and the UK ($8.6 billion) are expected to lead the globe in terms of digital ad spend, with China in fourth place with an ad spend of $7.4 billion.

By 2016, China is expected to overtake Japan and the UK with a projected ad spend of $16.48 billion. The US will still be far ahead however with a forecast ad spend of $55 billion.

Asia-Pacific however, already leads the world in mobile ad spend, which is expected to be around $2.6 billion this year, just ahead of the North America ($2.5 billion). Overall, global mobile ad spend this year will reach $6.6 billion.

In four years however North America is projected to outstrip the rest of the globe with a mobile ad spend of $12.4 billion, followed by Western Europe ($6.7 billion) and Asia-Pacific ($5.1 billion). In 2016, global mobile ad spend is expected to top $25.3 billion.

Mobile growth is fueled in these leading markets, such as the US, Western Europe and South Korea, by the simultaneous use of multiple screens, such as using a mobile phone while watching TV. However, other markets are proving slower to adopt multiscreen viewing.

“For example, in Argentina, Chile and Peru, fewer than 8 per cent of consumers reportedly used the mobile internet in 2011,” noted the study. “Advertisers in such markets will likely gain little by developing mobile sites with exclusive content tied to the most-viewed TV programs. In the US, by contrast, mobile sites are a vital part of many broadcasters’ plans to reward viewers and keep them watching.”

A major trend noted in the report is the greater presence of women online. Nevertheless, men still dominate among smartphone and mobile web users, it said. This is mainly because men are more likely than women to have higher social status, jobs and disposable income, particularly in developing nations. “Marketers wooing female demographic segments in emerging markets stand to reap major benefits as advanced technology becomes more widely available to women,” advised the report.

In Asia-Pacific, online media penetration is still patchy across the region, noted the study. “Internet use, for example, remains far greater in Australia, Hong Kong, Japan and South Korea than among consumers in mainland China and Indonesia," the report said. "India registered lower web penetration than any other major country in the world in 2011.”

Nevertheless the region is still posting impressive increases in GDP and consumer living standards. “For marketers, this is a win-win situation," the report concluded. "Digital media is attracting ever-larger audiences while traditional media retains much of its power. But advertisers will also need to up their games as regional consumers become more discriminating.”

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpeg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.png&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=268&w=401&q=100&v=20170226&c=1)

.png&h=268&w=401&q=100&v=20170226&c=1)