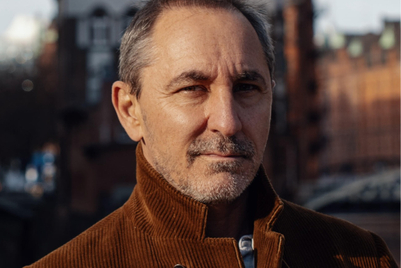

News that WPP had increased third-quarter sales by 26 per cent to £1.35 billion (US$2.4 billion) should give the group's indomitable chairman and CEO Sir Martin Sorrell a reason to smile in an otherwise bleak October.

That and Asia, where Sorrell has his wallet out while rivals wrestle with the prices being asked or lament the lack of attractive acquisition opportunities.

In more ways than one, October has been a month to forget. First, the group saw Samsung, with WPP for less than a year after the epic 2004 parent company pitch, defect along with Coca-Cola to Publicis-owned shops. On top of that, global creative guru Neil French resigned following offensive remarks reportedly made about female creative talent. Meanwhile JWT's golden touch in evidence in the last two years as the lead agency scooping the HSBC and Samsung briefs, failed to help net British Airways and Omo, despite holding the latter in the UK, where it is known as Persil, for 60 years.

Sorrell, though, spent the better part of October in Asia-Pacific. Marking his personal best this year, he made four trips to Asia, where WPP is without doubt the dominant communications group, but Omnicom's quest to bolster regional capabilities could give it a run for its money, not to mention a sprint after acquisition targets. In media briefings, Sorrell's preferred topics are the transfer of wealth from West to East and organic growth prospects, a subject that no doubt sets financial analysts' pulses racing.

The group has certainly had a strong run with organic revenue in August hitting six per cent -- itself doubling July revenues. So much so, Sorrell raised organic growth forecasts for the year from four to five per cent to up to six per cent.

As Europe stagnates, the developing economies of Asia and Latin America, where organic growth is running at double-digit rates, are firing up WPP's growth engines.

"China is growing for us at 22 per cent -- which is what it was in the first six months -- and India at 13 per cent," Sorrell notes. "I'm talking like-for-like growth, excluding acquisitions, that's four times or twice the rate we're growing in the first half of the year of six per cent around the world."

While Sorrell is reluctant to talk about acquisitions, the group has certainly been busier than rivals, not simply at the global level with Aegis Group, but in the region as well.

The purchase of Australia's The Communications Group, parent to the iconic George Patterson Partners, will go down as the acquisition of the year in Asia-Pacific. At the same time, the group also picked up stakes in a PR agency in Hong Kong, iPR Asia; Enterprise Nexus in India and China's Shanghai Advertising. According to Sorrell, more are in the pipeline for India and China in the coming months. Indeed, WPP agency executives tell Media, they have sizeable war chests at their disposal to go out and buy. Admittedly, these acquisitions are not enormous in the scale of WPP's operations, but certainly serve as a defensive move to checkmate rivals sniffing out opportunities. Looking in, industry observers say the series of acquisitions have left them guessing whether Sorrell is simply going after scale. "Is there a grand, as yet unseen vision because the leaves are dropping of the trees," says one industry source of client setbacks suffered by WPP agencies in recent global reviews. "Apart from media, how strategic is anything to Sorrell?"

But has the quest for scale made it more difficult to manage client conflict? WPP appears to have managed conflict better than rivals -- HSBC and American Express, Motorola and Nokia, and Shell and Caltex to name a few. "The parent company model has accommodated conflict to quite a sophisticated degree and partly that's to do with the fact that there's been concentration among clients, concentration among media owners and retailers," says Sorrell.

Nevertheless, JWT missing out on Unilever's global Omo review to micro network BBH has been read as unease over WPP's growing relationship with Procter & Gamble through Grey Global Group, despite BBH's parent company Publicis' equally extensive P&G business. Sorrell is quick to dismiss client conflict as a reason, concluding instead: "Probably the best man or woman won."

That and Asia, where Sorrell has his wallet out while rivals wrestle with the prices being asked or lament the lack of attractive acquisition opportunities.

In more ways than one, October has been a month to forget. First, the group saw Samsung, with WPP for less than a year after the epic 2004 parent company pitch, defect along with Coca-Cola to Publicis-owned shops. On top of that, global creative guru Neil French resigned following offensive remarks reportedly made about female creative talent. Meanwhile JWT's golden touch in evidence in the last two years as the lead agency scooping the HSBC and Samsung briefs, failed to help net British Airways and Omo, despite holding the latter in the UK, where it is known as Persil, for 60 years.

Sorrell, though, spent the better part of October in Asia-Pacific. Marking his personal best this year, he made four trips to Asia, where WPP is without doubt the dominant communications group, but Omnicom's quest to bolster regional capabilities could give it a run for its money, not to mention a sprint after acquisition targets. In media briefings, Sorrell's preferred topics are the transfer of wealth from West to East and organic growth prospects, a subject that no doubt sets financial analysts' pulses racing.

The group has certainly had a strong run with organic revenue in August hitting six per cent -- itself doubling July revenues. So much so, Sorrell raised organic growth forecasts for the year from four to five per cent to up to six per cent.

As Europe stagnates, the developing economies of Asia and Latin America, where organic growth is running at double-digit rates, are firing up WPP's growth engines.

"China is growing for us at 22 per cent -- which is what it was in the first six months -- and India at 13 per cent," Sorrell notes. "I'm talking like-for-like growth, excluding acquisitions, that's four times or twice the rate we're growing in the first half of the year of six per cent around the world."

While Sorrell is reluctant to talk about acquisitions, the group has certainly been busier than rivals, not simply at the global level with Aegis Group, but in the region as well.

The purchase of Australia's The Communications Group, parent to the iconic George Patterson Partners, will go down as the acquisition of the year in Asia-Pacific. At the same time, the group also picked up stakes in a PR agency in Hong Kong, iPR Asia; Enterprise Nexus in India and China's Shanghai Advertising. According to Sorrell, more are in the pipeline for India and China in the coming months. Indeed, WPP agency executives tell Media, they have sizeable war chests at their disposal to go out and buy. Admittedly, these acquisitions are not enormous in the scale of WPP's operations, but certainly serve as a defensive move to checkmate rivals sniffing out opportunities. Looking in, industry observers say the series of acquisitions have left them guessing whether Sorrell is simply going after scale. "Is there a grand, as yet unseen vision because the leaves are dropping of the trees," says one industry source of client setbacks suffered by WPP agencies in recent global reviews. "Apart from media, how strategic is anything to Sorrell?"

But has the quest for scale made it more difficult to manage client conflict? WPP appears to have managed conflict better than rivals -- HSBC and American Express, Motorola and Nokia, and Shell and Caltex to name a few. "The parent company model has accommodated conflict to quite a sophisticated degree and partly that's to do with the fact that there's been concentration among clients, concentration among media owners and retailers," says Sorrell.

Nevertheless, JWT missing out on Unilever's global Omo review to micro network BBH has been read as unease over WPP's growing relationship with Procter & Gamble through Grey Global Group, despite BBH's parent company Publicis' equally extensive P&G business. Sorrell is quick to dismiss client conflict as a reason, concluding instead: "Probably the best man or woman won."

+(900+x+600+px)+(3).png&h=334&w=500&q=100&v=20250320&c=1)

+(900+x+600+px).jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)