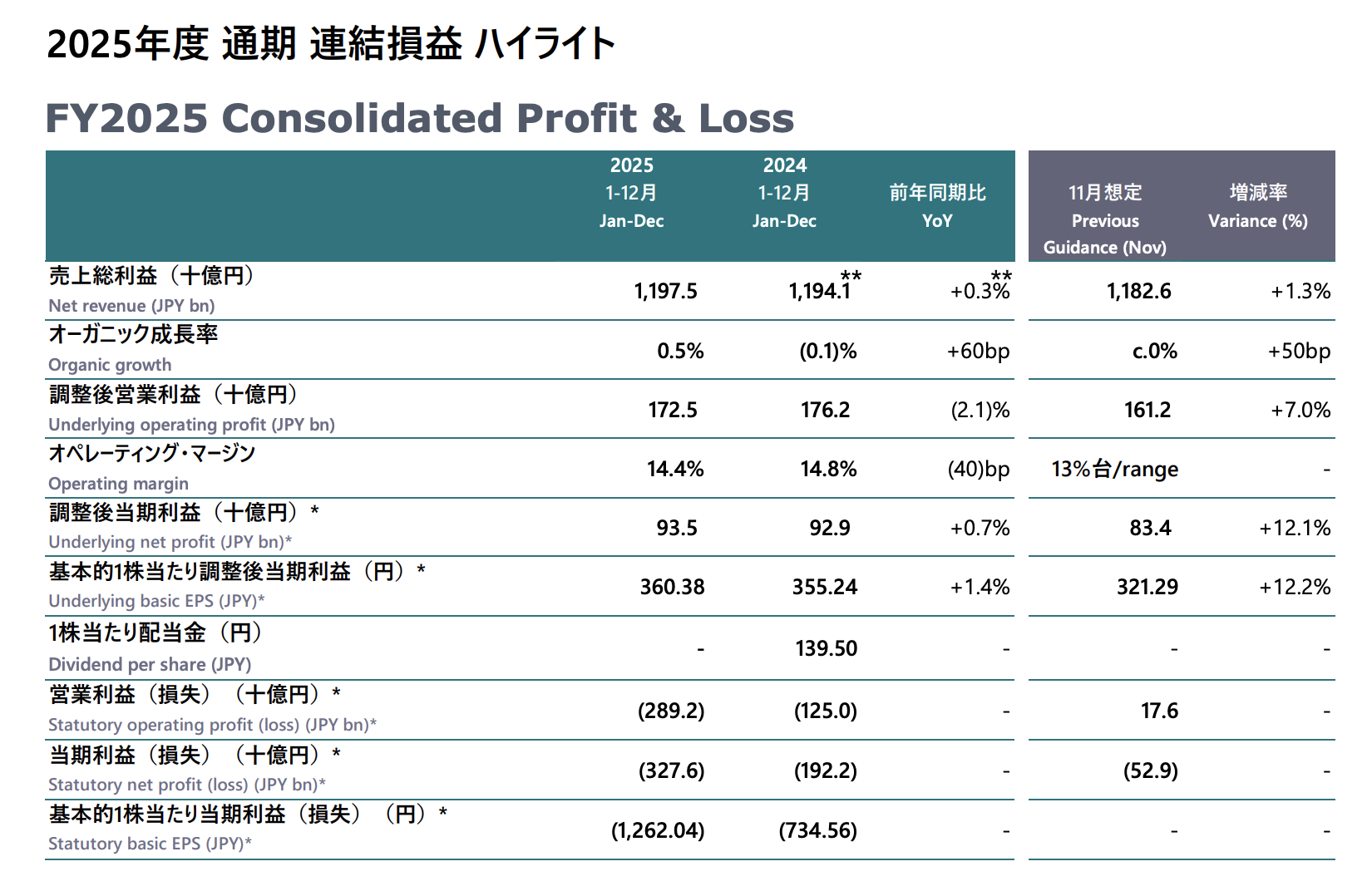

Dentsu fell to a record net loss of ¥327.6 billion (US$2.18 billion) in FY2025 after booking a ¥310.1 billion goodwill impairment in the fourth quarter. The results were released as president and global chief executive Hiroshi Igarashi prepares to step down, with longtime company executive Takeshi Sano set to take the helm from March 27.

The full-year results are announced as the group presses ahead with the ¥52 billion (US$338 million) restructuring plan outlined after its second-quarter earnings. Dentsu reduced headcount by 2,100 roles in FY2025 and said a further 1,300 cuts are planned.

For the first time, the agency will not pay the year-end dividend for FY2025 and forecasts no dividend for FY2026. Management described the dividend suspension as “regrettable” but said it was necessary to strengthen the balance sheet and preserve financial flexibility.

Despite the statutory loss, underlying profitability proved more resilient. Dentsu’s underlying operating margin reached 14.4%, ahead of November guidance of “around 13%”.

The group adopted what it calls an “extremely conservative” view of its pipeline and medium‑term growth, and explicitly stripped out any unrealised benefits from its ongoing cost‑reduction programme. Under this revised framework, Dentsu recorded an additional goodwill impairment loss of ¥310.1 billion (US$2.07 billion) in the fourth quarter alone, largely tied to its international units. The move slashed the group’s goodwill balance to ¥320.1 billion (US$2.13 billion) at the end of 2025, less than half the ¥697.1 billion (US$4.65 billion) held a year earlier, effectively front‑loading much of the remaining goodwill risk.

On costs, it is consolidating and reducing group companies and simplifying HQ functions, aided by business transformation built on AI and automation. By January 2026, it had halved the number of international entities from more than 1,000 in early 2021.

Revenue, profit and margin

Net revenue rose 0.3% to ¥1,197.5 billion (US$8.0 billion), with 0.5% organic growth slightly beating expectations. Underlying operating profit dipped 2.1% to ¥172.5 billion (US$1.15 billion), exceeding the ¥161.2 billion (US$1.07 billion) November forecast.

Underlying net profit edged up 0.7% to ¥93.5 billion (US$623 million). Statutory operating loss widened to ¥289.2 billion (US$1.93 billion).

Japan continues to anchor growth and stability; APAC (ex-Japan) is the weakest region

Outside Japan, conditions remained challenging across most regions, with CXM and creative dragging on performance despite better trends in media.

APAC, excluding Japan, remained the weakest geography. Net revenue dropped to ¥107.3 billion (US$715 million), with organic growth of negative 6.8%, reflecting continued softness in CXM and creative, though media again proved more resilient. There were tentative signs of stabilisation in the fourth quarter, when APAC ex‑Japan returned to positive organic growth for the first time since Q4 2022, helped by topline gains in China and India.

In the Americas, net revenue came in at ¥315.7 billion (US$2.10 billion) and organic growth was negative 3.0% for the year. Media activity was described as “stable”, but creative slipped and CXM continued to operate in a “challenging” environment, even though its quarterly organic growth improved sequentially over the year. The region’s underlying operating margin nevertheless improved by 40 basis points year‑on‑year, helped by strict cost control.

EMEA posted net revenue of ¥271.9 billion (US$1.81 billion) with an organic decline of 1.8%. Media, which accounts for more than 60% of the region’s net revenue, held steady, but CXM and creative both remained in the high single‑digit negative range. In the fourth quarter, the UK continued to face CXM headwinds, while Spain delivered positive growth “in all business domains”, signalling increasing divergence within the region.

Cost discipline and FY26 outlook

The FY2025 results also show Dentsu pushing harder on restructuring to restore profitability in its overseas portfolio.

The company said it has reviewed underperforming businesses with the goal of eliminating “loss‑making markets” defined as those with more than ¥10 billion (US$67 million) in cumulative investment. As part of that push, China and Australia, both loss‑making since FY2023, were returned to profit on an underlying operating profit basis in FY2025.

Dentsu has also initiated processes to downsize, withdraw from, or divest certain businesses and plans to continue this work into FY2026 in order to “maximise shareholder value”.

In FY2026, the company plans to invest another ¥26 billion (US$173 million), targeting total annual cost savings of ¥42 billion (US$280 million) and ultimately aiming to realise around ¥50 billion (US$333 million) of recurring savings in FY2027.

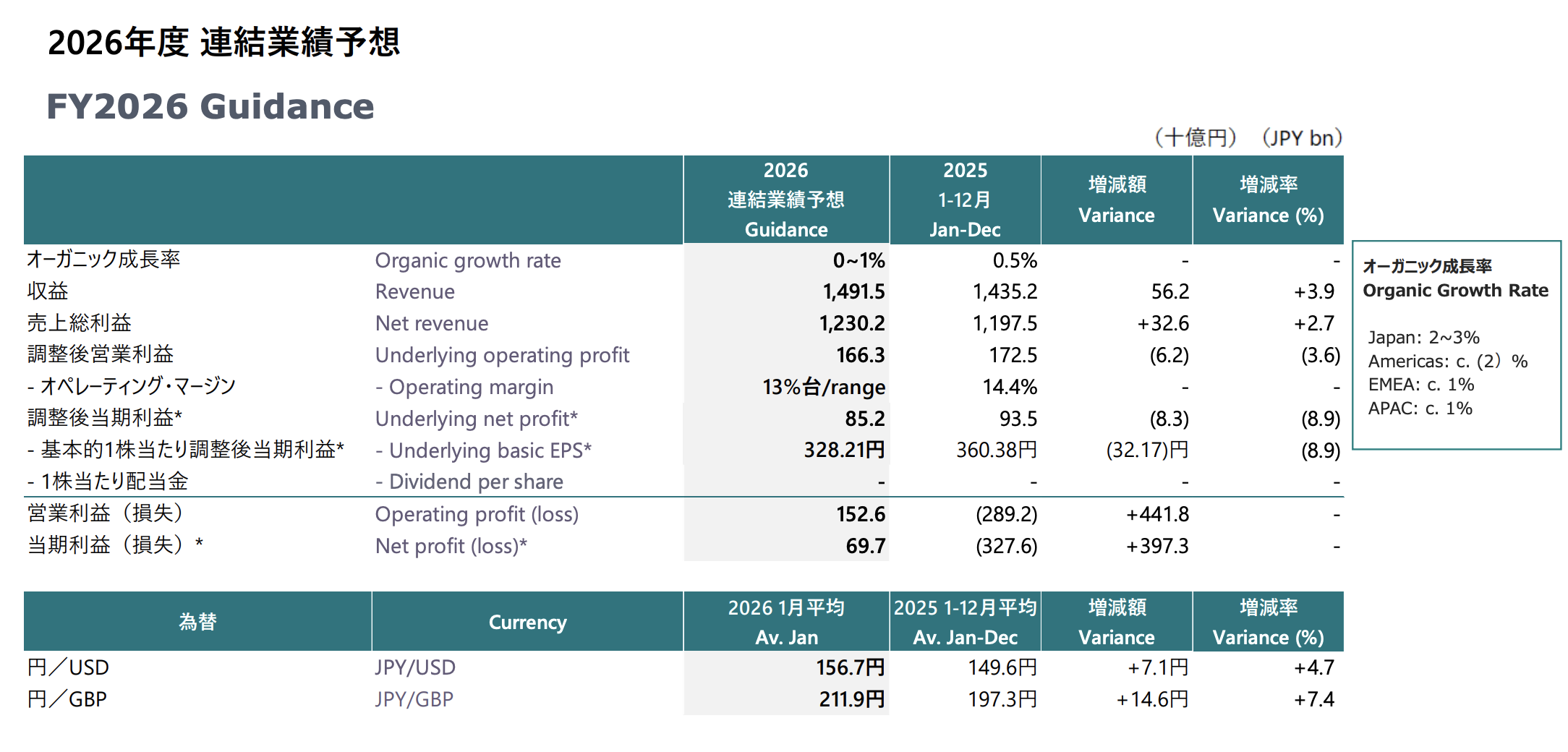

For FY2026, Dentsu is guiding for another year of modest top‑line expansion and disciplined margins. It forecasts group organic growth of 0–1%, revenue of ¥1,491.5 billion (US$9.94 billion) and net revenue of ¥1,230.2 billion (US$8.20 billion), up 2.7% year‑on‑year.

The group has withdrawn some of the FY2027 financial targets and capital policies it set out in its February 2025 mid‑term management plan, reflecting the weaker international outlook and the decision to reset goodwill. However, it is keeping its ambition to reach a 16% operating margin in FY2027, and said it plans to outline a refreshed strategy “early” in the current financial year to accelerate the transformation envisaged under its “One Dentsu” plan.

Source: Campaign Asia-Pacific