Following its inception in 1991 as the mobile arm of Japanese telecoms giant NTT, the brand has powered its way to becoming Japan’s leading mobile phone operator. With over 50 million customers, it has cornered over half of Japan’s mobile market.

Having led the world into the realm of 3G, wireless internet and mobile wallets, DoCoMo has done much to establish itself as a brand at the forefront of mobile technology. But DoCoMo (an abbreviation of ‘Do communications over the mobile network’ and a play on dokomo, meaning ‘everywhere’) has shown that belonging to one of the world’s largest telecoms groups does not guarantee continued market domination.

NTT recently reported that its net profit had tumbled by almost 22 per cent over the nine months to December - a slump that can largely be attributed to the drag of its mobile unit as it struggles to prevent its subscribers from transferring to fiercely competitive rivals Au by KDDI and Softbank.

DoCoMo’s troubles have become pronounced since the introduction of mobile number portability in Japan last year. The ensuing industry price war has forced DoCoMo to introduce a reduced tariff plan, which, despite having led many existing customers to change their subscription package, has been unsuccessful in attracting new business.

As DoCoMo’s mobile phone sales dwindle, Au reported its subscription rate in December to be up by almost two million since March, and has predicted a 30 per cent share of the market by next month. And Softbank continues to lure customers away from both competitors with aggressive advertising, price cuts and student plans, having signed the highest number of new subscribers for the eighth consecutive month in December.

To offset the customer drain, DoCoMo plans to tie up with Google to enhance the user-friendliness of its i-mode technology. But with au and Softbank already operating Google and Yahoo-based services, more is likely to be required to turn the network’s fortunes around.

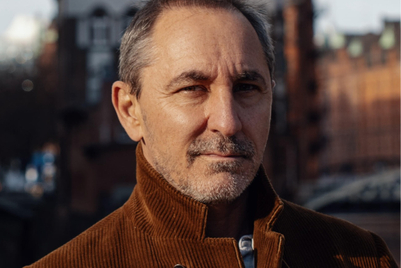

Chris D Beaumont, president and CEO, Grey Group Japan, and chief strategy officer, Grey Group Asia-Pacific

DoCoMo is unknown outside of Japan, despite less than a decade ago having the leading mobile internet technology (i-mode) and the opportunity to globally define the wireless internet standard.

DoCoMo is perhaps the best illustration of how Japanese technology prowess and management style is increasingly gaining less traction in the digital age.

When DoCoMo tried to go global, it included no gaijin (foreigner) in its leadership team. The issue for the company is clear and fundamental - how in an accelerating world can it foster a culture that can accommodate entropy and where the user and not technology is king?

Put another way, DoCoMo needs to think more about its brand and consumers - and the first step has to be internal brand visioning.

It is a hard ask; DoCoMo is still rooted in its parent NTT’s (telephone) mindset and Japan has historically provided a scale for acceptable ROI. However, this has perpetuated a local PDC standard that is not scalable like GSM.

Our brand new world demands that DoCoMo change quickly or it will decline.

John Goodman, president, Ogilvy & Mather Japan

If you look at NTT’s recent financial statements, there are several companies within the group, not just the mobile arm, that have caused large slides in profits. However, it is fair to say that the DoCoMo brand is struggling. The severe competition among the top three mobile providers in Japan (DoCoMo, Au, and SoftBank) shows no sign of slowing down, and fortunes are being spent on marketing communication activities.

One of the reasons for SoftBank’s success is management’s strong commitment to building the brand on a total level across the whole company. So, what can a once totally dominant market leader like DoCoMo, owned by a large and traditional corporation, like NTT, do to make sure that it is not overtaken by the challenger?

Given NTT’s strong history of product innovation, it is important not to panic and clutch at gimmicks.

Well-established brands should take confident steps to protect themselves and remember that brand revitalisation doesn’t mean changing the essential truths of the brand. DoCoMo could also use some fresh outside thinking. Only in Japan would the agency-of-record also be responsible for the campaigns of the two successful challengers.

+(900+x+600+px)+(3).png&h=334&w=500&q=100&v=20250320&c=1)

+(900+x+600+px).jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)

.jpg&h=334&w=500&q=100&v=20250320&c=1)