Who would have thought a monster with sharp teeth, large ears and a scruffy appearance would become the decade’s must-have toy?

Move over the polished looks of Barbie and Ken, ‘ugly-cute’ toys are having their moment in the sun, none more so than Labubu. The quirky plush monster from artist Kasing Lung’s 2015 storybook The Monsters exploded into a global craze via Pop Mart’s blind-box collectibles starting in 2019.

During Labubu’s breakout year in 2024, revenue jumped 700%+ year on year to roughly USD 420–430 million. The meteoric rise is often attributed to TikTok unboxings and high-profile celebrity spotting.

The ‘Lisa effect’ and global frenzy

A key driver of the global breakout came when K-pop star Lisa of girl group Blackpink posted about Labubu on Instagram Stories in April 2024, showcasing a plush keychain on her bag. Her post triggered a 30%+ jump in Pop Mart’s Southeast Asia sales that week alone, with instant sell-outs and resale prices surging up to 400%.

Reports of chaotic scenes tied to limited drops became common across APAC. Singapore fans queued for hours, and the August 2024 toy convention at Marina Bay Sands saw fans scrambling for Labubu Merlion pendants amid theft warnings. Similarly, South Korea temporarily halted sales over safety concerns, and in May 2025, Pop Mart halted all in-store Labubu plush sales in the UK after fights broke out, shifting stock exclusively online.

The demand was intense, to say the least. Until recently, engineered scarcity, limited drops and queuing culture created a Labubu gold rush. But now there are growing signs that Labubu may have peaked, with reports of resale prices down 50%+.

"Across Asia and international markets, the brand has entered what can be described as correction territory," says Humphrey Ho, CEO of Helios & Partners. "Secondary market prices have declined sharply from their 2024–2025 highs, in some cases returning to or falling below original retail prices as supply has expanded and speculative demand has cooled."

This shift aligns with Pop Mart’s decision to significantly ramp up production, estimated at approximately 30 million units per month, thereby reducing the artificial scarcity that previously fuelled resale premiums.

"The change has coincided with falling resale values and a broader stock price correction in 2025," adds Ho. ‘Given the low cost of production, Labubu’s scarcity was structurally fragile and easily disrupted once supply constraints were lifted."

Pop Mart experienced notable stock price corrections in 2025, tied to Labubu hype cooling and profit-taking after massive gains. In July 2025, there was a 6%+ drop in share price despite strong earnings forecasts, followed by a 40% rout from late August through December amid resale crashes, hype fatigue and short-seller pressure.

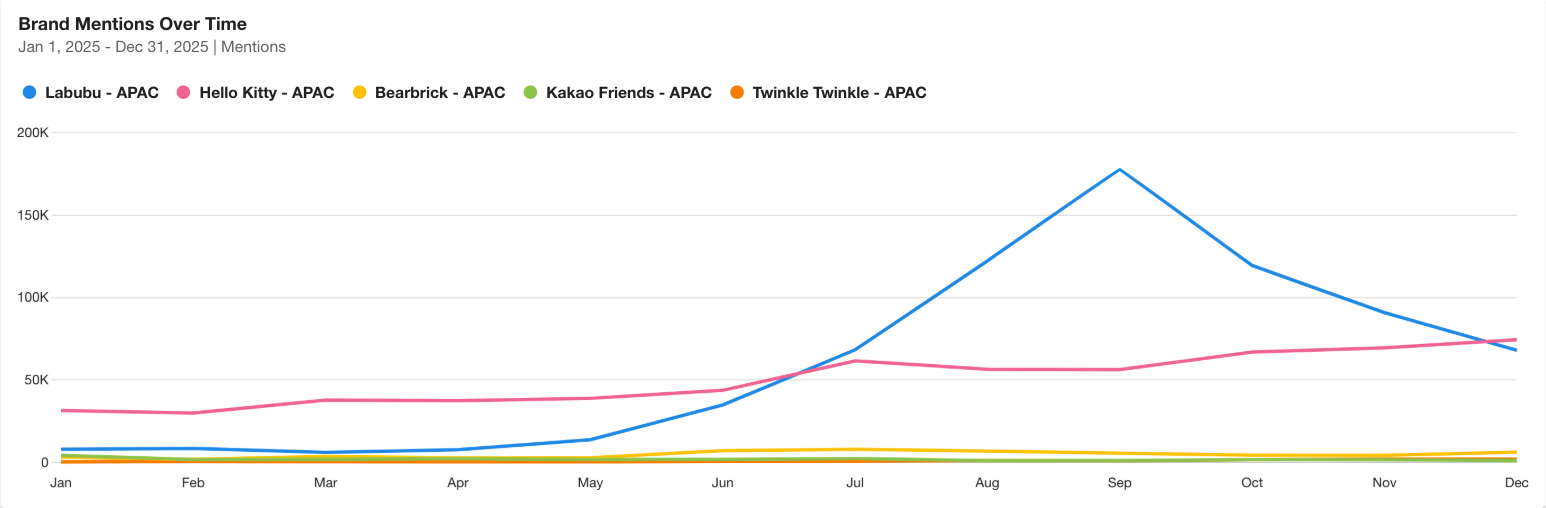

Brand chatter followed a similar arc. Labubu mentions peaked in APAC in September 2025, on the back of viral news around counterfeit 'Lafufu' dolls and safety concerns. UK authorities seized £3.5 million worth of fake toys, many failing safety tests, amplifying social media panic. By December 2025, mentions had fallen behind evergreen franchises like Hello Kitty.

"Labubu peaked in China and Southeast Asia in 2024, driven by social currency and offline-to-online virality," says Sasha Alwani, chief strategy officer, ASEAN, Vero. "In the US and Western markets, the brand peaked much later, around 2025, with celebrities like Rihanna accelerating adoption. That uneven spread suggests Labubu isn’t ‘over’, but just cycling through different maturity stages by geography."

A matter of maturity

Different markets and maturity stages may well be a factor here. David Born, licensing expert and CEO of Born Licensing, remembers being in the Pop Mart Robo Shop at Selfridges in London in late 2025 with a friend who was desperately trying to hunt down a Labubu for her niece.

"She had to register, then return during a one-hour timeslot just to pick it up, so the demand is still very real,’ says Born. ‘It’s too early to definitively call it a peak, though we might be getting close. The real test is whether Pop Mart can transform this frenzy into a sustainable, multi-channel brand with staying power beyond the initial wave."

While scarcity created the initial Labubu frenzy, longevity may require a shift from collectible toy to lifestyle brand: think Barbie or Transformers, which evolved from single-category products into evergreen IPs with hundreds of licensees across fashion, publishing and beyond.

"Pop Mart needs to lean into storytelling, forge strategic licensing partnerships, and give consumers reasons to stay emotionally invested in Labubu beyond the thrill of the chase,’ adds Born. ‘Content will be important and Sony Pictures are already in early development for a Labubu film."

Labubu’s soft power

Labubu’s appeal extends beyond fandom into cultural diplomacy. Despite 2025’s renewed Trump-era China tensions, tariffs and ‘decoupling’ rhetoric, Labubu surged in the US with Pop Mart sales up 1,200% YoY and celebs like Rihanna dangling them as status symbols, proving cultural exports can bridge divides where politics stall.

Meanwhile, Keir Starmer’s January 2026 China trip yielded Pop Mart’s pledge for a London European HQ and seven new UK stores (Oxford Street flagship, Birmingham, Cardiff), creating 150+ jobs within £2.2 billion trade deals. Starmer even got a Labubu for his kids, softening post-Brexit attitudes via Chinese pop culture.

But as Pop Mart has ramped up output of its plush monsters roughly tenfold to tens of millions of units a month, resale prices fell 50%+ on many models, and some SKUs slipped below retail as scalpers rushed to unwind inventory.

"Mass production makes economic sense but it’s cultural suicide without smart delivery," says Jacopo Pesavento, CEO Branding Records. "Labubu needs to stop thinking like a toy company and start operating like a religion that occasionally sells merchandise. Make the common stuff accessible but create grails that 99% will never touch. The moment every kid has one is the moment none of them matter."

Narrative vs aesthetic: the battle for longevity

But since Labubu’s rise was driven primarily by aesthetic trends rather than deep cinematic or literary ‘lore’, this could well turn out to be its fatal weakness, resulting in its appeal being short-lived. After all, aesthetic trends are fashion; they’re seasonal and replaceable. Pokémon didn’t survive because Pikachu was cute. Star Wars didn’t last because Yoda looked cool. They built worlds with stories.

"Labubu right now is a vibe without substance, a character without a journey," adds Pesavento. ‘The ugly-cute look is already being copied everywhere. Without real storytelling through comics, animations or user-generated content, Labubu is just waiting to be replaced by the next thing in someone’s feed. The window to build meaningful lore is closing fast."

Ngo Hong Phuc, group vice president, strategy & growth at Vero, points out that not all modern IP needs narrative lore; some thrive on aesthetic emotion. Think Hello Kitty or LINE Friends: highly expressive, minimally storied, but also enduring.

"Labubu taps into the ‘ugly-cute/creepy-cute’ zeitgeist, which resonates strongly with Gen Z and late millennials who prefer expressive, imperfect characters over polished icons," says Phuc. "Characters don’t always need a long narrative or cinematic universe."

The road ahead

In addition to ramping up production of Labubu, Pop Mart has engaged in an aggressive licensing push in 2025–26 which stretched from fashion (Uniqlo’s September 2025 apparel line featuring ‘The Monsters’ prints) to electronics (SanDisk-inspired accessories and phone charms via Pop Mart collabs), plus lifestyle extensions like Timber Workshop keychains, fast-fashion tie-ins and even animatronic toys under major deals. These moves aimed to embed the IP everywhere but risked diluting its exclusivity.

"The line between omnipresence and oversaturation can be razor-thin, and without a well-planned licensing strategy, Labubu risks becoming a commodity rather than premium licensing asset," says licensing expert Born. "I would encourage them to be selective about partners, ensuring they have high quality standards for licensee products and make sure that every partnership reinforces the brand’s core identity rather than diluting it."

There are already visible warning signs of brand dilution and over-accessorisation. The rise of counterfeits and look-alike characters has weakened Labubu’s premium positioning and negatively impacted resale prices, a direct consequence of broad licensing combined with viral demand.

However, whether Labubu becomes a long-term brand platform or a one-cycle craze remains to be seen.

"Pop Mart knows how to nurture evergreen characters by mixing scarcity, mainstream availability and strategic collaborations," says Phuc. "Even if Labubu can no longer achieve the same peak frenzy it had in Asia in 2024 and western markets in 2025, it’s already achieved a baseline cultural presence that can be nurtured over time."

Joey Khong, trends manager at Mintel, says that we have to accept that ‘Labubu’ and blind boxes and bag charms and the rest are more than ‘just toys’. They’re evidence of a massive demand for emotional anchors in a messy and uncertain world.

"It wasn’t just the ‘Lisa effect’ that drove popularity of Labubu,’ says Khong. ‘It was a cultural moment that showed how much adults value spaces and objects that allow them to express some individuality, and their need for acceptance and community."

A long-term brand platform or one-cycle craze?

The current phase of the Labubu phenomenon has drawn comparisons to historical boom-and-bust cycles such as Beanie Babies, where overexposure and speculative excess eroded long-term brand equity. Labubu often behaves like a luxury brand, but without the structural scarcity required to support that positioning.

"Based on current sales performance and market sentiment, Labubu aligns more closely with a major one-cycle craze with residual niche appeal rather than a multi-decade global franchise," says Ho. "While Pop Mart’s overall revenues remain strong and Labubu continues to be a significant contributor, the correction in the secondary market and expanded production signal a clear transition out of the pure hype phase."

Currently, Labubu has visibility and looks but lacks the three things that separate lasting brands from quick fads: story, community and evolution. There’s no narrative creating new reasons to care. There’s no fan culture where people create meaning beyond buying stuff. And there’s no evidence the brand can surprise us or grow. Yet, all hope might not be lost.

"Pop Mart could still save this with a smart 12-month pivot," says Pesavento. "Invest in storytelling that gives Labubu depth, create spaces where fans build the mythology together, stop licensing everything that moves, and bring back the mystery in how products drop."

However, if Pop Mart continues its current trajectory with Labubu, without deeper meaning to anchor the product, Labubu could well turn out to be just a short-term craze. "Stop just selling Labubu. Build the world Labubu lives in and let people pay to be part of that world," adds Pesavento. "Otherwise this is just another lesson in how businesses kill what makes things cool."

While interest in Labubu may well be waning, Crystal Yiu, head of insights & strategy, Culture Group, says Asian IP is the long-term platform brands need to pay attention to.

"While Labubu’s end is near, I believe we are only just starting to see the growth of Chinese IP for a myriad of reasons: namely rising nationalism, the reframing of ‘Made in China’ to ‘Created in China’ and the Asiafication of pop culture," says Yiu. "With the success of NeZha 2 and Black Myth: Wukong, it is clear that modern Asian IPs that reference or remix tradition and heritage are what consumers will be responding to the most."

Source: Campaign Asia-Pacific