![[L-R, clockwise]: JJ Lin wearing Giuseppe Zannoti shoes for his birthday party; A meme of Ge You's character from a 1993 sitcom still circulating to this day; Zanila Zhao is an actress who topped Kantar's latest CelebrityZ China Ranking; Yang Yang donning a Puma hoodie and dipping a Godiva chocolate into hot chocolate (Source: Sina Weibo)](https://cdn.i.haymarketmedia.asia/?n=campaign-asia%2fcontent%2f20190325083907_My+Post.jpg&h=570&w=855&q=100&v=20170226&c=1)

The four faces you see above are all number one in Kantar's latest CelebrityZ China ranking. Yet at the same time, they are not number one.

Yang Yang ranked top in 'brand connectivity'—which includes endorsement strength and influence on purchase intention—but only 11th overall.

JJ Lin was positioned first for his reputation and professional ability, but only came 13th as a whole.

Ge You has the highest standing in terms of differentiation from other personalities, but had to settle for 80th position overall.

Zanila Zhao moved up a notch from last year to top this year's ranking with soaring levels of reach and salience, but she scored low sub-rankings in professionalism and differentiation, and more modestly (she came 5th) for brand connectivity.

Why, then, is Zhao still number one?

Her ranking is indicative of how many brands are still choosing celebrities based on their ability to generate social buzz and digital traffic—and not necessarily trigger purchases or grow brand equity.

Kantar’s research found that 61% of brands that insisted on using only celebrities in China in the past three years did not achieve continuous growth in brand power. In other words, celebrity endorsement is really like "gambling", according to Kantar.

Power of exposure versus power of influence

Celebrities and brands represent a diverse collection of personalities and goals, and mixing and matching these together effectively is, of course, a complex task.

Celebrities who attract high volumes of social buzz and digital traffic do, in many cases, also attract short-term sales bursts, according to Kantar's chief client officer Eric Tan. However, without sustainable professional achievements and a positive public image, these celebrities' careers will not last long and hence they cannot contribute to long-term brand building goals such as changing consumer attitudes.

On the flipside, celebrities who perform well in their profession, usually either singing, acting, directing, composing or writing, and who act as good role models, can be a powerful influence.

Taiwanese singer/songwriter/director Jay Chou jumped 15 positions to number three this year, becoming the highest-ranking male celebrity in Kantar's index. Chou is an exemplar of professionalism, scoring impressively (second position) in that dimension. He has starred on the jury panel of popular TV show Sing! China three times, performed in 49 concerts in and outside China and launched two new songs within the last year. His rebound in the ranking came amid a decline in his social buzz volume.

If you search for 周杰伦 (Jay Chou’s name in Chinese) online, the most relevant results are related to his professional activities, such as “singing”, “album” or “song”, observed Kantar. For celebrities who are more 'overnight stars' in the social media world, a similar search may skew toward gossip, proving they have little or no meaningful commercial influence. "If a celeb couldn’t produce high-quality work one after another for a long while, or has a shocking scandal exposed, then his or her commercial influence will evaporate," says Tan. "Unfortunately, some marketers are often behind the curve in understanding this."

Although the fast growth spurts of China's influencer industry has given marketers almost unlimited choices, it has also caused consumer overload and fatigue. Attention spans have been drastically shortening, as demonstrated by the frequent fluctuations in Weibo's Hot Search function. Celebrities whose lifestyles and actions play into this pose uncertain risks for brands since the traffic they 'create' reflects their commercial value only in real time.

"In China, KOLs come and go, and they may not be popular next month because trends change so fast,” sums up Regina Hui, VP of communications at McDonald’s China.

According to Kantar data, the size of China's influencer market will exceed RMB100 billion in 2020, and income generated by fan consumption will be about RMB50 billion. In the face of numerous tiers of KOLs (famous celebrities on the top tier followed by mid-tier, micro- and long-tail influencers) and punishing communications targets, most brands are only in the early stage of quantifying KOL value based solely on price comparisons, says Tan.

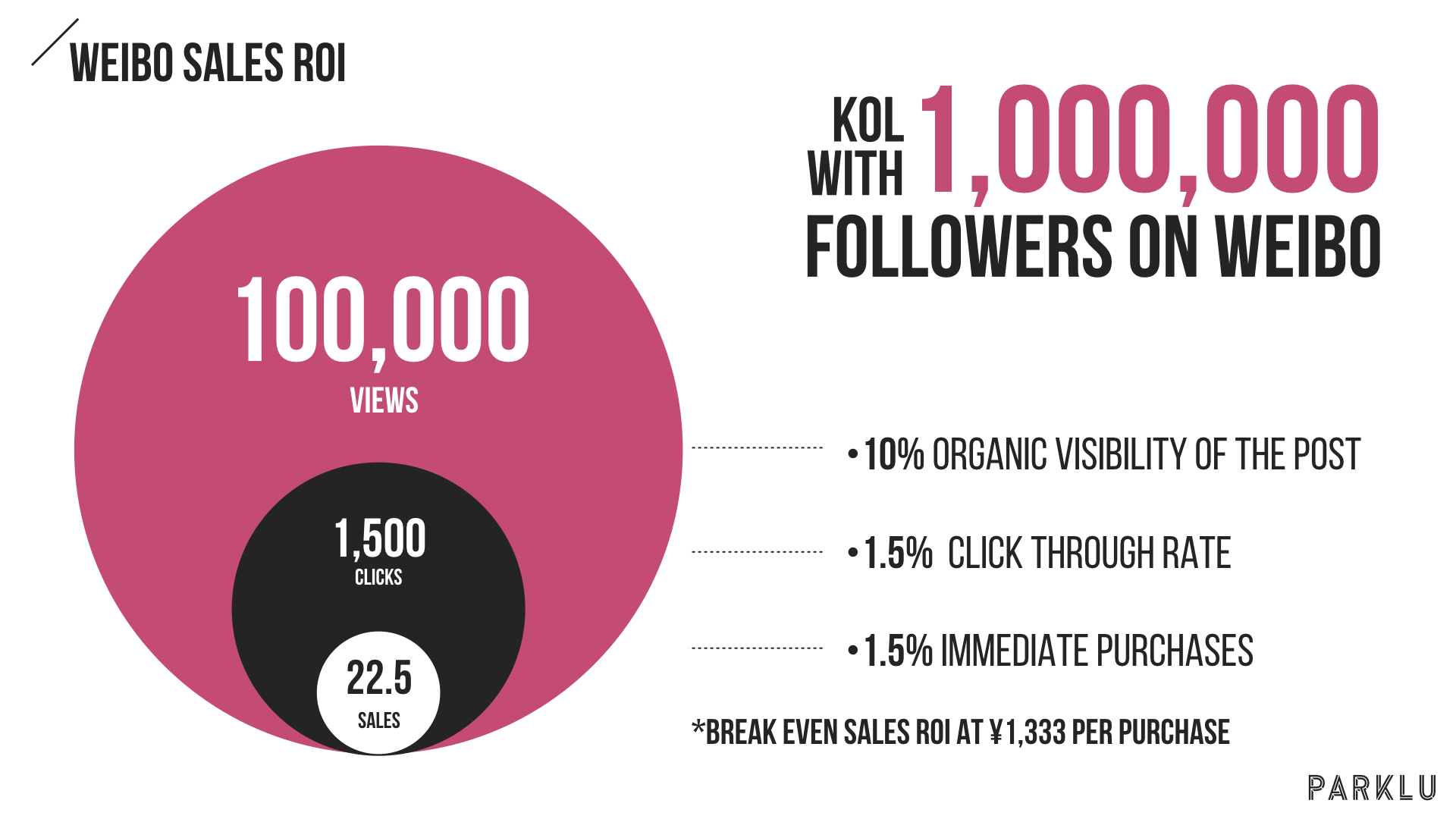

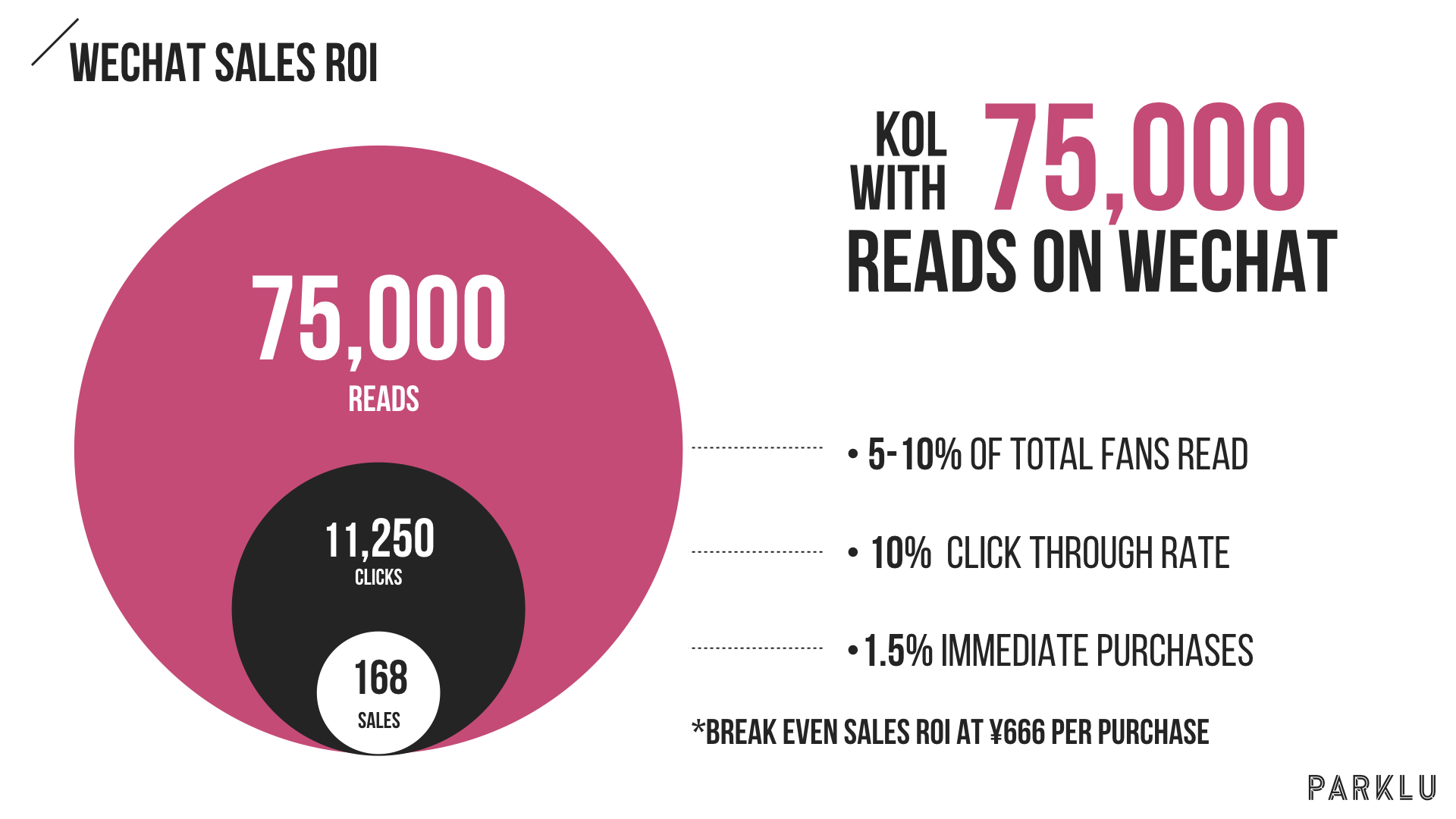

There are handy tools for this, such as Parklu's free KOL Budget Calculator that lays out fees and impressions across 11 social media platforms in China (see a Weibo example below).

This is, as the agency states, only a rough cost estimate, because it does not include the native advertising fees charged by social platforms or agencies. Kantar's Tan also advises brands not to make the mistake of thinking "the more fans a KOL has, the more impressions, the better".

According to Parklu statistics, when a KOL with one million followers (disregarding fake metrics from bots and assuming all followers are real) on Weibo posts about a product, they are going to gain organic views from about 10% of their followers, on average. About 1.5% will click through, and out of this group, fewer than 23 people will make a purchase right away. For a brand to achieve break-even ROI from same-day sales, the items sold must be priced at ¥1,333 RMB (US$199), recommends Parklu.

"Even if the KOL does not bring about sales, his or her value is in educating the market and delivering knowledge for us" -- Fu Peng, JiangXiaoBai

Talk China with Campaign at Digital360Festival

Digital360Festival is Campaign's flagship event in China, where we'll be hosting senior figures from across the industry to share their expertise on all the latest hot topics from the region. It will be held on March 28 in Shanghai. For all information, please visit www.digital360festival.com.

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.png&h=334&w=500&q=100&v=20170226&c=1)

_92.jpg&h=268&w=401&q=100&v=20170226&c=1)

.jpg&h=268&w=401&q=100&v=20170226&c=1)