In times of trouble, though, opportunities may exist. During the last major downturn in Asia, the Sars-induced coma of 2003, a number of media operations responded by streamlining sales forces and outsourcing ad sales. The current predicament, though, may prove rather more complicated. Those expecting a sudden fillip for the various media reps that dot the region could end up disappointed.

“It could end up benefiting independent media sellers if large and small media organisations have to shed staff,” says Andrew Butcher, who represents Fortune, Wallpaper and The Week. “But then there could be actual consolidation and exits of media brands.”

While the theory is sound enough, says Jonathan Hardy, CEO of media sales house Energy, it is hard to get too excited just yet. “There is that conversation at the moment, but we’ve yet to see it materialise,” he points out. “I’m hesitating because it’s been talked about for a long time. This kind of environment forces everyone to focus on what works and what doesn’t. You do see publishers open to solutions they may not have been open to previously.”

This new-found affection for flexibility, in an industry that can look a little hidebound, does not necessarily benefit media reps. Butcher and Hardy point out that online media budgets could benefit next year as media titles look to build on growth in this area. “Online selling is still evolving,” offers Butcher diplomatically. His implication, that print media reps are not easily swayed by the lower sums of money available selling online space, may have profound implications for his industry.

“A local deal, online, would not seem to be as attractive as some of the big global deals, but there could be a steady stream of these US$10,000 deals,” says Hardy, who sells online space for the New York Times group. “Obviously it’s a lot more work, but it’s a case of not having all your eggs in one basket.”

The Economist Asia-Pacific publisher Tim Pinnegar is a little more blunt. “They need to adapt and understand online. We have a policy where our reps can sell all of our products. The issue you face is that sometimes reps tend to be quite long in the tooth - and they might be the ones who don’t understand online so well.”

Understanding online is just one issue. Competing with established volume players such as Pixel Media and iHub is another. And there remains a question over how much interest there currently is from Asian advertisers in sites belonging to global publishers.

“The amount of online campaigns coming out of these markets is limited,” says Mezzomedia’s Matthew Farrar.

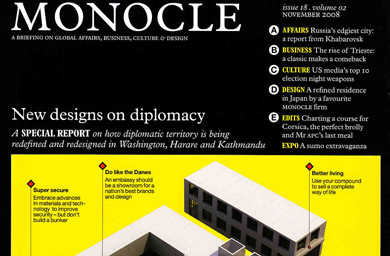

Still, Farrar - who represents Condé Nast and Monocle, among others - believes that many media sales shops can draw some solace from the quality of the publications they represent. “In general, the media we represent will continue to be consumed by affluent business and leisure travellers who are the least affected by the downturn,” he says. “I’m sure I’m not the only one who will tell you that we’re experiencing an element of a ‘flight to quality’.”

Despite Farrar’s confidence, it seems unlikely that the typical rep curse - where sales soars to such an extent that the publisher takes them back in-house - will strike any of the region’s sales houses soon. Instead, offers Hardy, paying attention to a rather more prosaic maxim should offer some guidance through the turbulence in 2009.

“The key to making the print portfolio work is very much the old 80:20 rule - you had better be sure that the 20 per cent which produces 80 per cent of your revenue is the right 20 per cent,” he says.

Or, as Butcher notes, make a virtue out of being small. “The cockroaches will survive the media holocaust.”

Got a view?

Email feedback@media.asia