When there is a crisis, a company’s sales come in lower than expected. Almost all luxury brands have reported shrinking numbers during the first half of 2020, and it is safe to think that Q3 results will be disappointing for most luxury players — whether they are market leaders or small brands.

Customers all over the world are reluctant to get back to “normal,” and most parts of the world can’t for several more months. China has been reporting significant growth rates in the luxury sector recently, and many global luxury brands have been counting on China to be their silver lining. However, this recent growth has, to a large extent, been driven by repatriation (meaning sales that customers would otherwise have made during overseas travels). With travel routes to Europe and the US closed, Chinese luxury customers have been shopping domestically, which has driven the luxury demand inside Mainland China.

Yet, this strong increase in demand in China could not offset the drastic decline in demand in both Europe and the US, at least during the second quarter of 2020. As such, many brands across categories like luxury cars, high-end jewelry, watches, and luxury fashion are sitting on enormous inventories and are looking at empty stores.

The few customers who come into stores don’t stay long — they act purely transactionally and are less likely to engage in intensive conversations with store staff. That has resulted in sharply-declining revenues, record-breaking levels of stock, disillusioned or frightened sales employees who spend limited time with customers, and one of the worst cash-net-working-capital situations in the history of the luxury industry.

The pressure on companies is immense, and desperation leads to the urge to take action and improve revenue and inventory with sale promotions. I hear the same argument over and over again: “This is an exceptional period, so we need to promote.” Another common argument is that “competitors also promote.” And lastly, many managers of luxury brands are convinced that they can manage the fall-out from short-term price reductions.

They greatly underestimate the damage that promoting a luxury brand can cause. Additionally, many new brands think that the only way to survive short term is to lower prices. From startups, I often hear that “if we were established, we could ask for higher prices, but now all we can do is use promotions.” But I have never seen even one of these brands succeed.

I call this the Easy Growth Trap. Reducing prices is the easiest of all marketing measures and can be done in seconds. Because it is so easy, many managers feel it will not cause catastrophic harm, at least not in the short-term. But this could not be more wrong, especially for luxury segments. Taking a closer look reveals why.

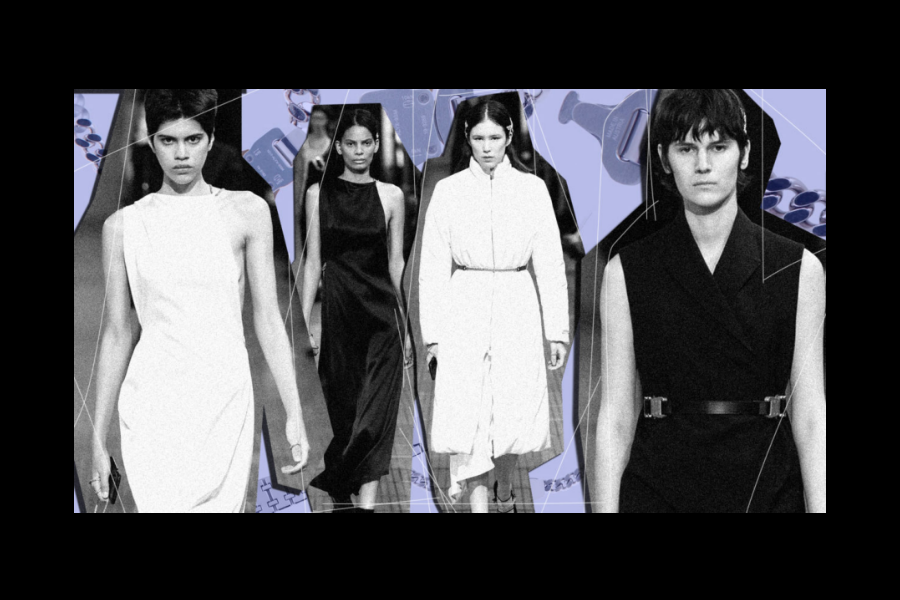

Let’s compare two customers of a luxury fashion brand. The first — we can call her Stefanie — is a loyal customer, follows the brand closely, and regularly buys several pieces from the newest collections. She values the brand’s timelessness and quality and is willing to pay a significant price premium, as the brand’s extreme value is reflected in its “luxury” prices. As one of the most loyal customers, Stefanie has significant financial means and is not affected by the crisis.

The second customer is Alice. Alice rarely buys luxury items (only when she can get a good deal). Her ability to buy a luxury fashion item like a handbag depends on her income and bonuses. At the moment, she is extremely careful with her spending levels, as she does not expect any bonus, and her job seems in danger as her company is struggling.

Let’s say that the brand Stefanie is loyal to has started discounting as a result of the pandemic. It will risk losing her business forever. Items that Stefanie paid for at full price just weeks earlier are now 30 to 40-percent off. Stefanie sees the promotion and is furious that the brand has effectively punished her for purchasing early and often.

Even worse, the brand now signals to Stefanie that the brand is actually worth much less than Stefanie thought. There is no better way to piss off the best customers and alienate them forever than to discount luxury goods.

Alice, in turn, will not buy any luxury items, since the uncertainties around her bonus and her job will make her temporarily reluctant to buy them. As a result, the temporary price reduction does not activate sales but incentivizes the most loyal customers to break up with the brand and move on.

That is why the Easy Growth Trap is deadly. It seems enticing at first — like a silver bullet to get a brand out of this crisis. But it’s quite the opposite. What was supposed to be the brand savior will only significantly weaken brand equities over the long run. It is one of the biggest illusions in business, and the price brands pay for it is enormous. Burberry, for example, had to restructure and lay off a large amount of staff after pushing heavy discounts at the beginning of the pandemic. It may take years for the brand to recover.

There is no easy way out when a brand is in crisis, so all aspects must be deeply analyzed. It’s myopic to blame only external factors for poor performance. External factors are usually just catalysts for greater internal issues. A brand’s most important asset is its equity — whether it is in crisis or not — so it should never be traded for easy growth.

Instead, luxury brands need to do their homework, connect closely with their most loyal customers, and develop strategies to create what is essential in luxury: desire. When there is desire, customers will be willing to pay, especially your best and most loyal ones. When there is a lack of desire, even your most drastic discounts will only have one effect: weakening the brand. Don’t fall for the trap.