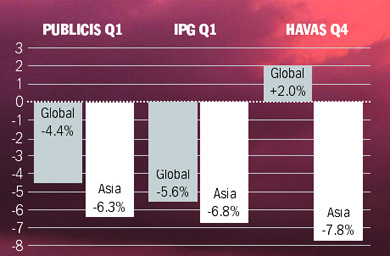

WPP and Omnicom have also reported first-quarter falls in revenue on an organic basis, though neither splits out performance in Asia.

“If you exclude China and India - markets that are expected to grow an agency’s revenues by approximately four to five per cent - any holding company will easily show a five to 10 per cent decline from a regional perspective,” said one executive at a global holding company.

“The third quarter of 2009 will be the quarter to watch because it will clearly define what’s going to be said about performance in the region during the recession.”

The latest figures cast doubt on the theory that building Asian operations will keep companies growing during the downturn. Indeed, a recent research report from Morgan Stanley, quoted in Western media, described Asia as a “potential liability”

“The thing about Asia is that we have some of the best markets in the world and some of the worst markets,” said a source at WPP.

Publicis and WPP pointed to Australia, New Zealand, Japan, Singapore and South Korea as markets holding back their regional performance. One holding company source argues that Publicis has suffered because of its relatively limited exposure to India and China, the major growth markets. Meanwhile, according to Greg Paull, principal at R3, Interpublic has the largest wholly owned office in Japan of any of the global holding companies.

Analysts say the groups poised to do the best in 2009 are those with the biggest operations in China and India, those that have diversified into areas such as digital, and those with less exposure to sectors such as automotive.

“Clients that agencies used to rely on aren’t as reliable,” said one analyst. “For example, outside Singapore, where the Government is a huge advertiser, there isn’t as much activity. In Australia, the Government went from being the largest advertiser the fifth-largest. Agencies would have been hit by that.”

See Opinion