Principal media is hard‑wiring itself into media trading as TV dollars chase streaming audiences, broadcasters lose ad guarantees, and CMOs face ever‑shorter windows to prove effectiveness, according to Forrester's, Make Principal Media Principled Media report.

The practice is already widespread. Over half (52%) of US marketing decision‑makers surveyed said they expect tighter marketing budgets in 2026, and 81% of the B2C marketing executives plan to increase their use of principal media in 2026. Although the data focuses on US marketers, many regional media strategies are downstream from HQ-based decisions.

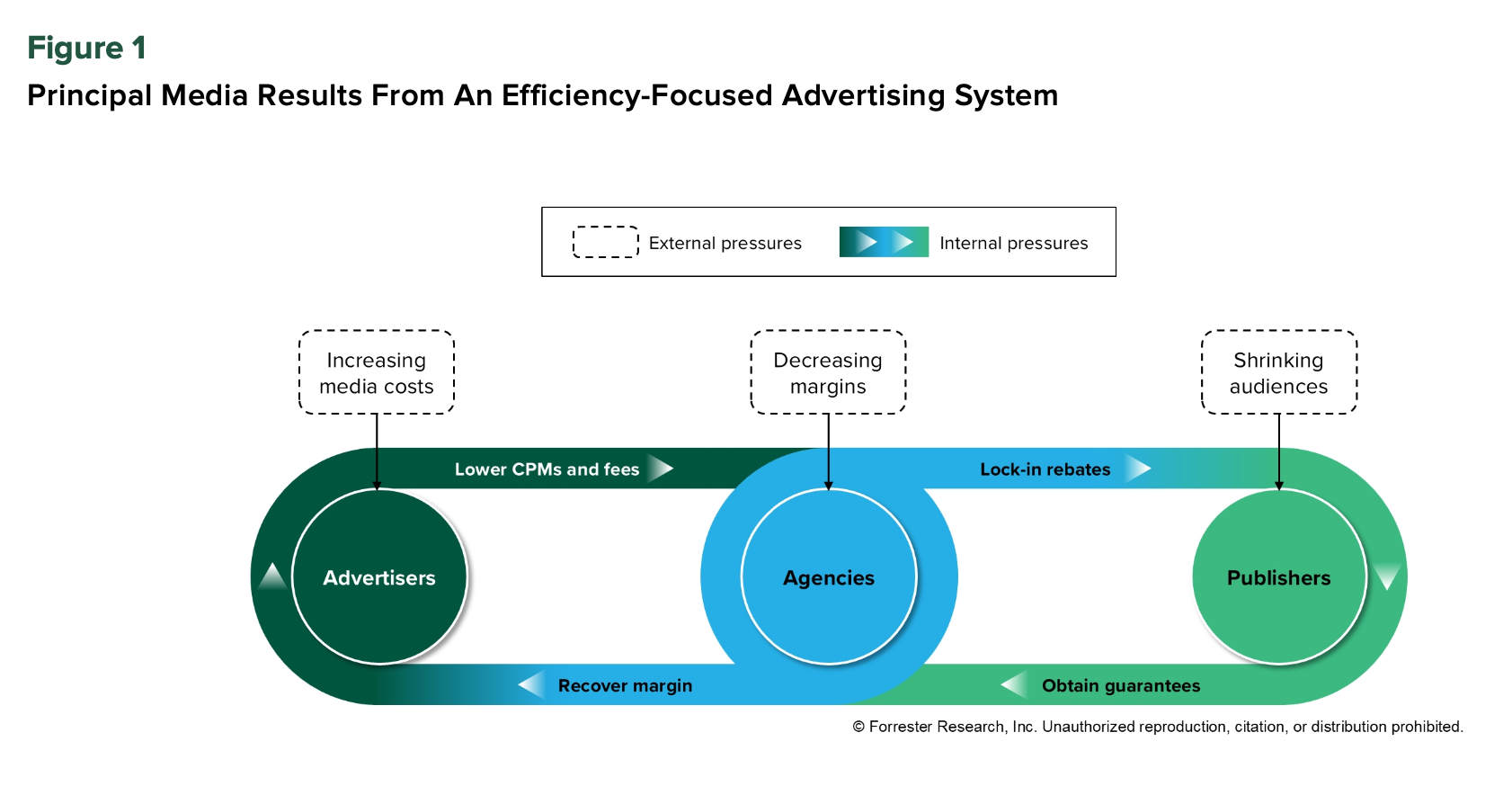

“Principal media isn’t a loophole, it’s the inevitable outcome of an industry addicted to efficiency and under relentless budget pressure,” said Jay Pattisall, VP and principal analyst at Forrester. In principal structures, the agency buys inventory at an undisclosed discount, then resells it at a price below standard publisher rates while bundling additional value such as volume, guarantees, or data‑driven targeting.

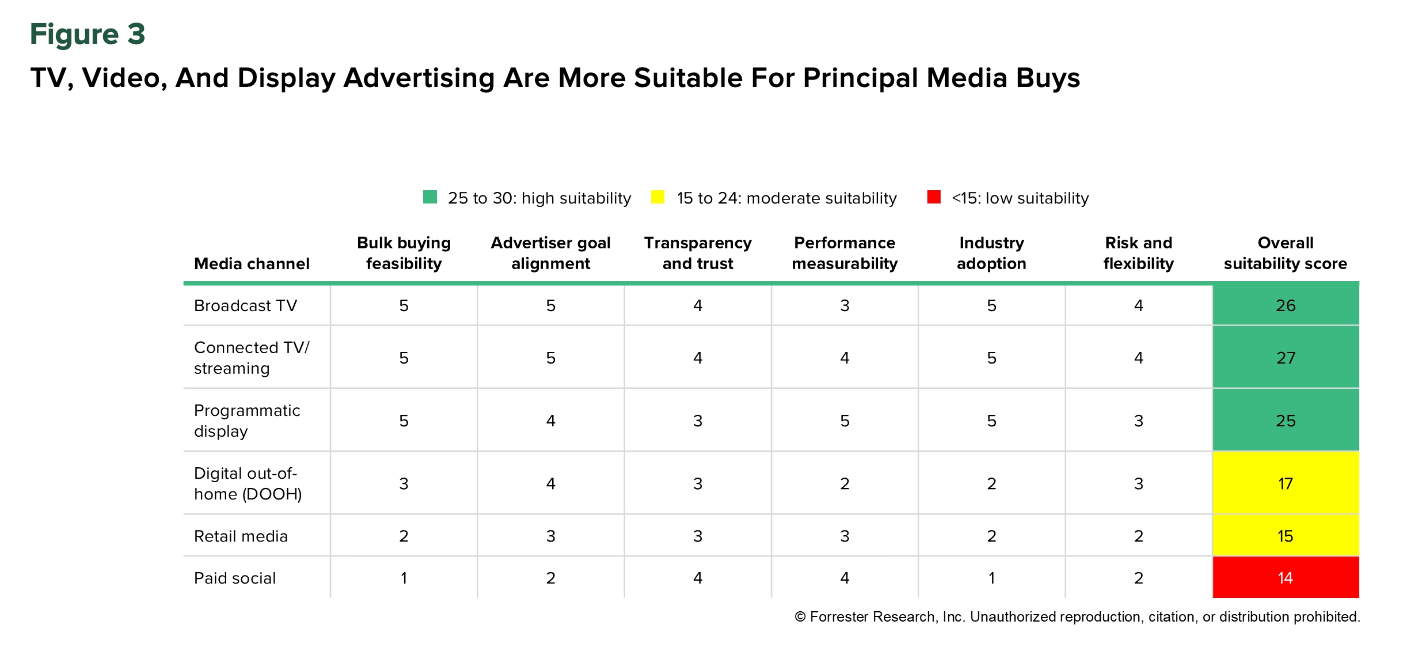

In APAC, that pressure is colliding with the reallocation of spend away from traditional TV and into streaming, CTV and social video. A 2025 MAGNA report forecasted APAC ad revenues will grow 4.6% in 2025 to US$301 billion, but traditional media owners’ ad revenues are expected to fall 3% globally as TV, print and radio continue to lose ground to digital pure‑play platforms. Media Partners Asia projects that TV’s share of video ad spend across key Asian markets will decline from about 59% in 2025 to 51% in 2029, while streaming’s share rises from 31% to 38%.

These shifts create conditions that principal media thrives on. Broadcasters still need volume and visibility on future cash flows, while advertisers want discounts and guarantees as their buys move into more volatile auction‑based environments. The report notes that as broadcast TV is being eclipsed by streaming, traffic on the open web is losing to AI‑powered answer engines, forcing publishers to rethink yield management and inventory packaging.

Forrester found that when agencies commit to large principal media packages, they effectively underwrite a portion of that volatility for TV and video owners.

“Given the investments of TV publishers to create, distribute, and monetise high‑quality video, principal media commitments reduce publisher revenue uncertainty,” said Ramsey McGrory, president of Prisma at Mediaocean, in the report.

Short‑term wins, long‑term trade‑offs

Forrester reports that 81% of US B2C marketing executives plan to increase their use of principal media in 2026. This is a substantial uplift from the 47% of the Association of National Advertisers members who said they had used principal media in the preceding 12 months in a 2024 study.

Marketers are using principal media as a lever to pull to manage budget realities. One global CPG marketer told Forrester that when agencies rate 10% lower than other buys, this has major implications for a global advertiser spending hundreds of millions of dollars annually.

In a transparent, non‑principal buy, the advertiser remains on the hook if performance is poor and budgets are cut mid‑flight. Meanwhile, in principal models, agencies act as “principals” by funding the inventory upfront and often only getting paid if guaranteed outcomes are delivered. Pattisall explained: “The real shift isn’t toward cheaper CPMs, it’s toward outcome‑guaranteed buying that mitigates advertiser risk."

The report is clear that this efficiency comes with long‑term costs, particularly in trust and strategic flexibility. Chris Moreno, SVP of paid media at NP Digital, warned that while principal media is a “margin‑friendly growth engine,” the cost in the long term is trust, as advertisers seeking lower CPMs and guarantees must accept limited visibility.

Forrester also links principal media’s growth to the compressed tenures of CMOs, pegging it at 3.9 years. In 2024, the figure was 4.1 years.

“If you’re a CMO and the average tenure is as short as it is, you’re not thinking about five years out. You’re worried about keeping your job,” McGrory said in the report.

The report notes that heightened budget scrutiny incentivises marketers to focus on quick efficiency wins, pushing leaders to prioritise cost savings over longer‑term brand building. For CMOs, principal media might be an efficiency boost to prove value.

Pattisall explained that principal media has become a durable feature of the media buying landscape. He added: “Despite the controversy, principal media has become a business mainstay because it delivers what CMOs need most: predictable costs, guaranteed outcomes, and budget relief."

The report maintains that making principal media a lasting value driver depends on deeper transparency from both marketers and agencies about how these buys are structured and measured. When principal buys are clearly marked in every plan and report, and all media is judged by the same performance, this could help keep trust in the buy. This means executing contracts that emphasise on disclosure and focus on effectiveness and operational honesty

As Ashwini Karandikar, executive VP of media, technology, and data at the 4As, put it: “With the right level of disclosure within principal buys, marketers, agency executives, and media owners can maintain both effectiveness and trust.”

Source: Campaign Asia-Pacific