The downturn reflects changing drinking habits, especially among workers.

“Traditionally, young people were taken out for beers by a senior colleague after work,” says Masa Ogawa, managing director, Japan Kantar Research. “But this custom is outdated, due to changing attitudes about work.”

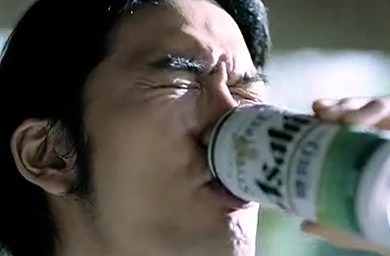

Plus today’s youth have less discretionary income. “When young people get together to chat, they drink tea,” says Koji Egusa, managing director, Ogilvy & Mather Japan, who came to the agency as a 25-year veteran with Suntory at Dentsu. How are the big four recruiting young drinkers? “They’ve produced a lot of ‘have a beer with daddy’ commercials, but this hasn’t yielded results,” he adds.

Beer sales are overwhelmingly driven by price, so much so that the big four brewers kept prices flat for 18 years, says Euromonitor research manager Kelvin Chan, until brewers finally tested consumer resolve with higher prices in February 2008.

Deflation from 1999 to 2005 and competition among chain retailers made the price stability possible. But the clincher was the debut of a category of inexpensive, beer-like drinks - happo-shu and new genre. The story of happo-shu and new-genre beer, and how the big four created these ultimately self-defeating product extensions, is a case study in devaluing your own market.

Tax avoidance was the impetus for the launch of the new beers. In October 1994, to counter weak consumer spending, Suntory launched Hop’s Draft, brewed using 65 per cent malted barley. In Japan, beer is heavily taxed, based on a four-tier scale of malt content, and Hop’s Draft had low enough malt to be taxed at less than the 220 yen per litre levied on traditionally brewed lagers.

Hop’s Draft became an overnight sales sensation. Suntory’s rivals cried foul, but eventually followed suit. Kirin introduced Tanrei in 1998, Sapporo launched a dozen less successful low-malts, and Asahi joined belatedly in 2001 with Honnama.

These cheap, low-malt beers were dubbed happo-shu, literally ‘sparkling beverage’. Despite being hybridised with rice, potatoes, corn syrup and sugars, happo-shu sold well enough to match half of Japan’s lager sales by 2005, mostly by displacement.

Next malt was abandoned altogether, as the big four created yet another beer category, called ‘third beer’ by some and ‘new genre’ by others. In February 2004, Sapporo launched Draft One, a drink brewed from pea protein, hops and caramel, and Suntory followed in June with Super Blue, a wheat-based brew. Kirin and Asahi weren’t far behind with soybean entries, Nodogoshi Nama and Shin Nama, respectively.

Faced with a loss of revenue, Japan’s tax authority upwardly revised the tax rate several times from 1996 to 2005. But significant price disparities persist today. New genre beer has a 30 per cent price advantage over traditional beer and 20 per cent over happo-shu. Sales of new genre beer are still growing - up 13 per cent last year over 2007 - while both traditional lager and happo-shu fell seven per cent. Of February’s shipments of 31 million cases, 30.1 per cent was new genre and 23 per cent happo-shu, while traditional lager beer hit a record low of 46.8 per cent.

Japan’s combined sales of these beers - traditional lager, happo-shu and new genre - equal only 89 per cent of the lager-only 1994 peak.

In other words, 3.2 billion litres of full malt beer sales have been supplanted by low-margin substitutes with low consumer loyalty.

Got a view?

Email Feedback@media.asia