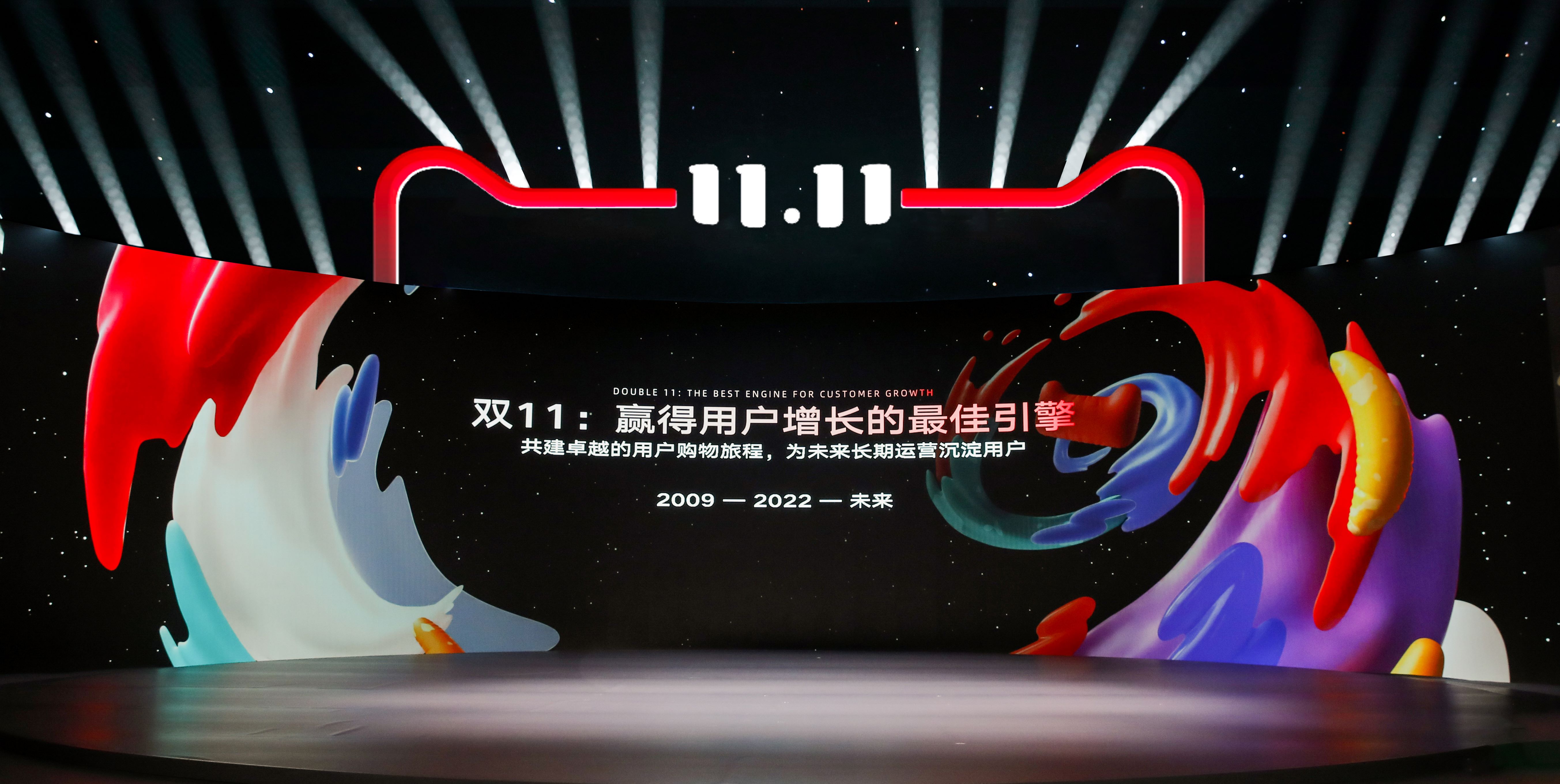

11.11 shopping festival turns to long-term, sustainable growth

Amid competition and economic uncertainty, more brand participants in China's preeminent ecommerce festival in China may be seeking deeper customer engagement beyond driving up GMV with discounts.

by Minnie Wang

Please sign in below or access limited articles a month after free, fast registration.

If you don’t yet have an account, you can register for free to unlock additional content. For full access to everything we offer, view our subscription plans.

Sign In

Trouble signing in?

Register for free

✓ Access limited free articles each month

✓ Email bulletins – top industry news and insights delivered straight to your inbox

Subscribe

✓ Unlimited access to all Campaign Asia content

✓ Real-world campaign case studies and career insights

✓ Exclusive reports, industry news, and annual features