The report attributed continued growth in emerging markets to the burgeoning middle classes, youthful populations, and sizeable foreign direct investment.

“The growth in large emerging markets such as China is projected to add at least 70 million new consumers to the global middle class per year, which is an additional 500 million new middle-class consumers by 2020," said Vicky Eng, global retail lead, Deloitte US. "This new wave of consumption represents a huge opportunity for consumer businesses.”

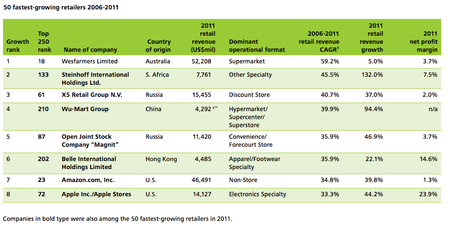

In Asia-Pacific, these companies were led by Australia's Westfarmers Ltd (which also topped the global list of fastest-growing brands), China's Wu Mart Group, Hong Kong's Belle International Holdings limited and China's Suning Appliance Co Ltd.

Success in these markets however requires the company to invest in gaining a deep understanding of local consumers’ tastes and preferences, forging a strong cultural fit with local partners, and attracting and retaining local talent, added Eng.

Overall, the revenues of the world's 250 largest retailers exceed US$4 trillion in the fiscal year 2011 (which includes companies with fiscal years through to June 2012). This is represents a 5 per cent year on year increase in retail revenue.

Globally, the list of top retaielrs was led by Wal-Mart Stores, US, followed by Carrefour, France and Tesco, UK.

Asia-Pacific's best performing retailer in 2011 is Japan's Aeon Co which ranked at number 13 in the global top 250 list. Aeon is followed by Seven & i Holdings, Japan (16), Woolworths Ltd, Australia (17) and Westfarmer's Ltd, Australia (18).

“Growth opportunities for many of the world’s largest retailers continue to be driven by global expansion in an attempt to make up for slow-growing or stagnant domestic markets,” said Dr. Ira Kalish, director of global economics at Deloitte Services. “Despite a stumbling global economy, consumers continued to spend in 2011, which has served to boost global revenues."

Deloitte's report highlighted a growing number of retailers ramping up their efforts in foreign markets with Australia a prime target. "With domestic growth prospects stalling for many retailers in North America and Europe, the relative strength of the Australian economy has tempted many overseas retailers to consider entering the Australia market," said the report.

For example, Costco has committed US$140 to new branches while Ikea plans to double its store footprint in the market. H&M has plans to launch in the market while Amazon is building a warehouse to facilitate direct shopping.

Globally, the FMCG sector overtook fashion and hardlines & leisure goods posting 5.6 per cent revenue growth and accounted for more than two-thirds of the Top 250 revenue in 2011. Revenue growth declined for fashion goods retailers in 2011, to 5 per cent from 7 per cent in 2010. The hardlines and leisure goods sector posted good profitability and solid gains in revenue in 2011, though not as robust as in 2010.

Although the companies comprising the FMCG sector are large, averaging more than $21 billion in retail revenue, they are the least global: In 2011, nearly half operated only within their domestic borders. As a group, they operated in an average of 4.9 countries, compared with 9 countries for the Top 250 as a whole.

Nevertheless, the sector generated nearly 23 per cent of its total retail revenue from operations in foreign countries, the result of several large, truly global operators like Carrefour, AS Watson and hard discounters Schwarz and Aldi, each of which generated more than half of its revenue from foreign operations.

Along the same lines, in 2011, for the first time the share of North American top 250 retailers that remained single-country operators fell to less than half. Still, only 15 per cent of the North American region’s retail revenue came from foreign operations. Asia Pacific was the only region with a lower percentage of foreign revenues, driven by limited international expansion of the Japanese companies.

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.jpg&h=334&w=500&q=100&v=20170226&c=1)

.png&h=334&w=500&q=100&v=20170226&c=1)

.png&h=268&w=401&q=100&v=20170226&c=1)

.png&h=268&w=401&q=100&v=20170226&c=1)